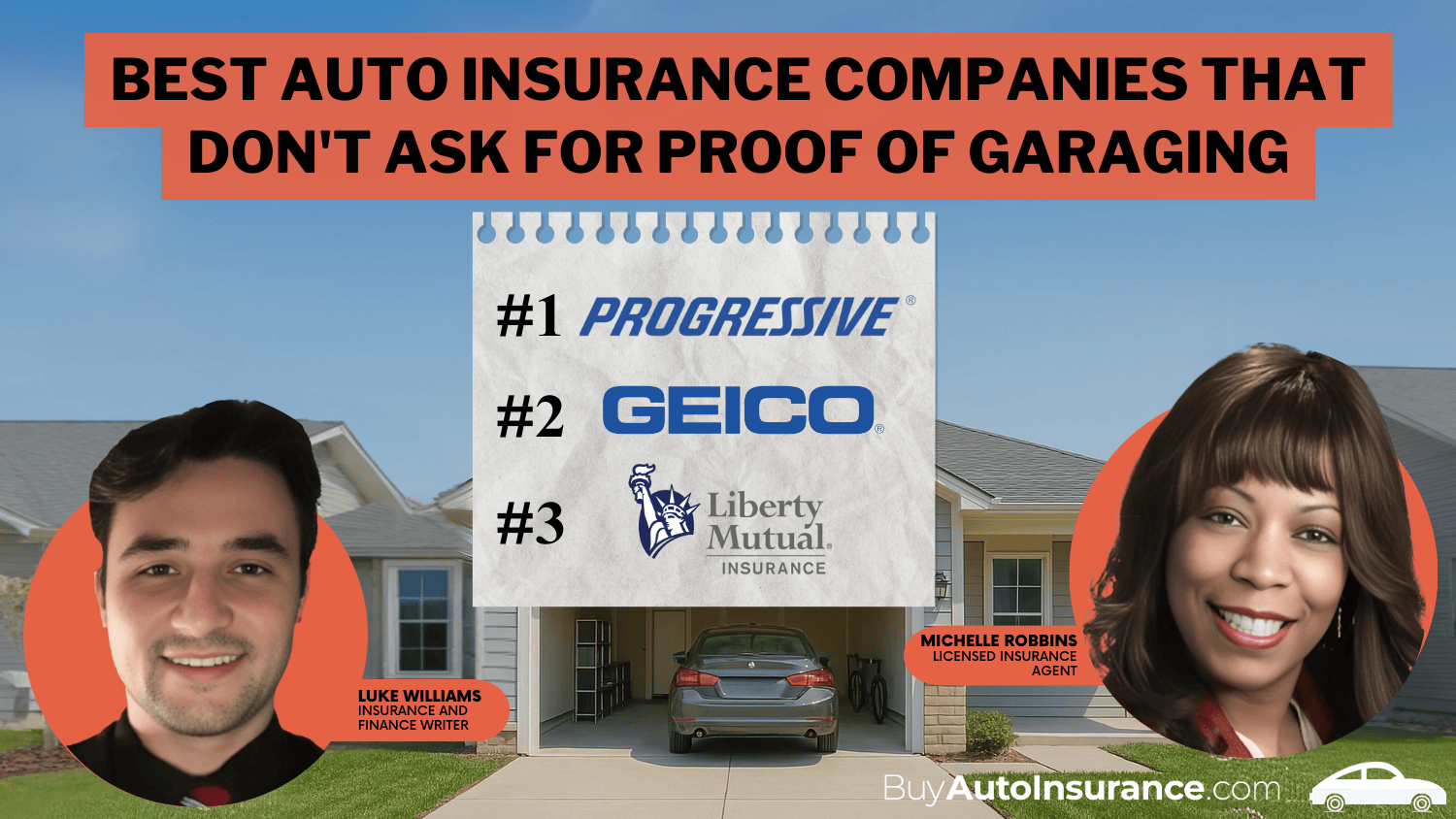

Best Auto Insurance Companies That Don’t Ask for Proof of Garaging in 2025 [Check Out the Top 10 Companies]

Progressive, Geico, and Liberty Mutual are the best auto insurance companies that don’t ask for proof of garaging. They offer monthly rates starting at $63 and flexible options for those without a permanent parking spot. These insurers eliminate the need for a proof of garaging address while delivering competitive coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Apr 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage No Garaging

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage No Garaging

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsProgressive is the top pick among the best auto insurance companies that don’t ask for proof of garaging. Likewise, Geico and Liberty Mutual provide flexible coverage options for drivers without a permanent parking spot.

While many insurers require proof of garaging to assess risk, these companies remove that obstacle, making them ideal for those seeking convenience and competitive coverage.

Its comprehensive deals make Progressive the top choice for reliable auto insurance. For further details, check out “Auto Insurance Coverage Types: What You Need To Know” to understand your options and choose the right coverage for your needs.

Top 10 Company Picks: Auto Insurance Companies That Don't Ask for Proof of Garaging

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $183 | A+ | Competitive Rates | Progressive | |

| #2 | $165 | A++ | Affordable Coverage | Geico | |

| #3 | $200 | A | Flexible Plans | Liberty Mutual |

| #4 | $185 | A+ | Comprehensive Options | Nationwide |

| #5 | $153 | A++ | Military Focus | USAA | |

| #6 | $195 | A++ | Reliable Service | Travelers | |

| #7 | $168 | B | Trusted Provider | State Farm | |

| #8 | $197 | A | Member Benefits | AAA |

| #9 | $213 | A+ | Personalized Support | Allstate | |

| #10 | $203 | A | Customer Satisfaction | Farmers |

Get instant access to top auto insurance quotes from companies that don’t require proof of garaging by simply entering your ZIP code into our free comparison tool.

- Progressive, Geico, and Liberty Mutual offer coverage without proof of garaging

- Flexible policies are available for drivers without permanent parking spots

- Progressive is the top pick, offering monthly rates starting at $98

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Competitive Insurance Rates: Provides low-cost insurance rates for non-proof of garaging drivers.

- Solid Financial Strength: Its A+ rating reflects Progressive’s financial strength over the long term in issuing auto insurance coverage.

- Bundling Discounts: Explore further details in our “Progressive Auto Insurance Review,” where you can find information on how you can get up to 10% off when bundling home and auto insurance policies.

Cons

- Limited Options: It does not offer as many customizable policies as other leading insurance providers.

- Higher Premiums in Specific Areas: Insurance rates may increase significantly for drivers in high-risk regions.

#2 – Geico: Best for Affordable Coverage

Pros

- Affordable Coverage: Offers low-cost insurance premiums for drivers, even if proof of garaging is not required.

- Generous Discounts: It provides a 25% discount on insurance when bundling multiple policies, like home and auto.

- Good Student Discount: Geico offers discounts for students with good grades, helping young drivers save on their premiums.

Cons

- Limited Support for High-Risk Drivers: Insurance choices may not be ideal for drivers with multiple accidents or tickets. Find out more by reading our “Geico Auto Insurance Review.”

- Occasional Customer Support Issues: Some customers struggle with responsive insurance support and customer service timeliness.

#3 – Liberty Mutual: Best for Flexible Plans

Pros

- Flexible Insurance Plans: It offers a variety of customizable insurance policies without requiring proof of garaging information.

- Wide Range of Discounts: Discounts are available for homeowners, hybrid vehicles, and even online insurance purchases.

- Strong Financial Stability: Being A-rated by A.M. Best, Liberty Mutual is known for reliable long-term insurance protection.

Cons

- Higher Premiums: Insurance rates may be higher than those of some of Liberty Mutual’s competitors in the market.

- Geographic Limitations: Our “Liberty Mutual Auto Insurance Review” highlights that insurance discounts may not always be available in all regions across the U.S.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Comprehensive Options

Pros

- Comprehensive Coverage: Offers a wide variety of insurance policies to meet the diverse needs of drivers. Obtain further insights from our “Nationwide Auto Insurance Review.”

- Bundling Discounts: Nationwide provides a 20% discount when customers bundle home and auto insurance policies.

- Strong Financial Stability: Nationwide’s A+ rating from A.M. Best provides rock-solid insurance support and financial dependability.

Cons

- Higher Premiums Without Discounts: Insurance rates can be higher if customers do not use bundling options.

- Slow Claims Process: Some Nationwide insurance policyholders have reported delays in processing insurance claims.

#5 – USAA: Best for Military Focus

Pros

- Financial Stability: USAA’s stable financial strength is reflected by its A.M. Best A++ rating.

- Exceptional Military Protection: It provides custom insurance coverage for active-duty military members, veterans, and their families.

- Military Discounts: They provide exclusive insurance discounts for the military, such as loyalty discounts.

Cons

- Limited to Military Families: Our “USAA Auto Insurance Review” says that insurance plans are not accessible to all and restrict coverage to specific individuals.

- Fewer Policy Options for Civilians: The availability of insurance policies is significantly restricted for non-military individuals or families.

#6 – Travelers: Best for Reliable Service

Pros

- Reliable Insurer: Travelers provides excellent auto insurance claims and customer service.

- Strong Financial Support: Travelers’ A++ rating provides stability and economic security. Our article “Travelers Auto Insurance Review” will help you learn more.

- Several Insurance Discounts: Travelers provides discounts for hybrid vehicles, excellent payment history, and bundling policies.

Cons

- Higher Premiums for Some Drivers: Insurance rates may be more expensive for drivers not qualifying for specific discounts.

- Limited Online Tools: The Travelers insurance website could provide more features for easier management of insurance policies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – State Farm: Best for Trusted Provider

Pros

- Reliable Insurance Company: State Farm is well known for its reputation and long history of reliability.

- Bundling Insurance Discounts: State Farm offers up to a 17% discount for bundling home and auto insurance policies.

- Widespread Availability: State Farm’s insurance services are available nationwide, ensuring easy driver coverage access.

Cons

- Lower Financial Stability Rating: Explore what goes beyond a B rating from A.M. Best, which may raise concerns for some customers who favor higher ratings, in “State Farm Auto Insurance Review.”

- Fewer Specialized Insurance Options: State Farm does not provide as many niche policies as other insurance providers.

#8 – AAA: Best for Member Benefits

Pros

- Exclusive Member Perks: AAA policyholders enjoy roadside assistance and other unique membership benefits.

- Bundling Discount: Save up to 25% when combining home, auto, and additional policies. Unlock additional information in our “AAA Auto Insurance Review.”

- Strong Financial Foundation: AAA’s A rating reflects its solid and reliable financial backing.

Cons

- Member-Only Discounts: Some auto insurance savings are limited to paid AAA members only.

- Location-Based Offers: Insurance discounts can depend on the customer’s specific region or state.

#9 – Allstate: Best for Personalized Support

Pros

- Personalized Insurance Service: It offers customized insurance solutions with exceptional customer support service.

- Bundling Insurance Discounts: You can save up to 25% by bundling home, auto, and life insurance policies together. For further details, read our article, “Auto Insurance Bundling Discount“.

- Financial Stability: Allstate’s A+ rating reflects strong financial stability and long-term insurance reliability.

Cons

- Increased Premiums: Non-bundling clients can have significantly higher insurance premium costs in total.

- State-Specific Insurance Discount: Some Allstate insurance discounts are not available in certain states or geographic areas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Farmers: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Farmers Insurance is renowned for outstanding claims service and customer care support.

- Bundling Insurance Discounts: Up to 20% off is available for bundling more than one insurance policy, such as home and car insurance.

- Strong Financial Stability: Farmers’ A rating from A.M. Best ensures long-term financial stability and reliability. Look at our “Farmers Auto Insurance Review” for expanded insights.

Cons

- Higher Premiums for Some Customers: Farmers’ insurance rates may be higher than those of other auto insurance providers.

- Limited Online Tools: Farmers’ digital tools for managing insurance policies online are not as robust as those of competitors.

The Importance of Auto Insurance That Doesn’t Require Garaging Proof

Auto insurance without proof of garaging is suitable for someone without a permanent parking space or who wants a more straightforward application process. However, that can still affect monthly rates, so let’s examine how various companies and coverage levels differ.

Companies That Don't Ask for Proof of Garaging Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $107 | $197 |

| $115 | $213 | |

| $103 | $203 | |

| $75 | $165 | |

| $108 | $200 |

| $93 | $185 |

| $98 | $183 | |

| $83 | $168 | |

| $105 | $195 | |

| $63 | $153 |

As you can see in the table, Geico provides minimum coverage at $75 and full coverage at $165, while USAA provides minimum coverage at $63 and full coverage at $153. These providers serve drivers who seek flexibility without demonstrating where they park.

To get the lowest rates without proof of garaging, compare insurers, as factors like driving history affect pricing.

Scott W. Johnson Licensed Insurance Agent

Choosing a provider that skips proof of garaging offers convenience and competitive rates. It allows drivers to get coverage without worrying about parking conditions, which can sometimes increase auto insurance costs.

This policy saves time and offers flexibility, simplifying the insurance experience for drivers. When asking, “How much does auto insurance cost?” remember that pricing and convenience can be affected by the lack of proof of garaging.

Discounts From Auto Insurance Providers Without Proof of Garaging

Auto insurance companies that don’t require proof of garaging still offer numerous discounts to help reduce premiums. These discounts provide savings to policyholders and are tailored to their circumstances, making insurance more accessible.

Auto Insurance Discounts From the Top Providers for Companies That Don't Ask for Proof of Garaging

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Multi-vehicle, Safe Driver, Anti-theft, Defensive Driving |

| Multi-policy, Safe Driver, Anti-theft, New Vehicle, Early Signing, Good Student | |

| Multi-policy, Signal Safe Driving, Good Student, Multi-car, Homeowner, Defensive Driver | |

| Multi-policy, Multi-vehicle, Good Student, Military, Defensive Driving, Safe Driver | |

| Multi-policy, Multi-vehicle, Homeowner, Online Purchase, Hybrid Vehicle, New Vehicle |

| Multi-policy, SmartRide, Good Student, Anti-theft, Accident-Free, Paperless |

| Multi-policy, Multi-vehicle, Safe Driver, Continuous Insurance, Homeowner, Online Quote | |

| Multi-policy, Multi-vehicle, Safe Driver, Accident-Free, Good Student, Drive Safe & Save | |

| Multi-policy, Multi-vehicle, Good Payer, Hybrid/Electric Vehicle, Homeowner | |

| Multi-policy, Multi-vehicle, Good Student, Safe Driver, Military, Loyalty |

Top providers like Geico, Allstate, and State Farm offer various discounts, including multi-policy, safe driver, and good student discounts. Other companies such as Liberty Mutual and Nationwide provide additional savings opportunities through anti-theft, paperless, and accident-free discounts.

Does anyone have advice for this garaging situation? Need help…

byu/triforcevibes inInsurance

As the table shows, multi-policy and safe driver auto insurance discounts are the most common across providers. These discounts incentivize safe driving habits and bundling policies, which benefit both the company and the insured, offering them better rates.

In conclusion, choosing an insurance provider that offers discounts without needing proof of garaging can result in substantial savings. This is especially helpful for drivers looking for cost-effective solutions, including those needing high-risk auto insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Companies That Don’t Ask for Proof of Garaging

Finding an auto insurance company that allows you to purchase a policy without listing a permanent address will be difficult. In many instances, proof of garaging for insurance goes along with having a permanent address.

All insurance companies want to know your address. Your insurance provider may occasionally need to send you documents in the mail, but your address is also essential in deciding your car insurance rates.

If you are unable or unwilling to provide a permanent address to your insurance company, you may ultimately be too risky to cover. In this instance, only nonstandard or high-risk car insurance companies would be willing to take you on as a policyholder.

Some of the most popular nonstandard auto insurance providers in the U.S. include the following:

- Direct

- Kemper

- GAINSCO

- Dairyland

- The General

- Geico

- Progressive

- Safe Auto

- Infinity

- National General

- Hallmark

- Foremost

- Founders Insurance

- Titan

- Bristol West

One or more of the companies listed above may be willing to take you on as a client, even if you do not have a permanent address. But you can expect to pay higher-than-average rates for your policy. And you probably won’t be able to get more than liability coverage on your vehicle.

Why Insurance Companies Ask for Proof of Garaging

Proof of garaging is a way for insurance companies to assess your risk. Insurers consider several things when determining your car insurance rates, including the following:

- Age

- Gender

- Marital status

- ZIP code

- Car make and model

- Credit history

- Driving history

- Level of coverage

Proof of garaging is one of the ways insurance companies can help keep your insurance rates down. If you park your car in the garage at night or whenever you’re home, it is less likely to be vandalized or damaged in a hit-and-run or inclement weather.

Because the above factors can impact your car insurance rates, it’s tough to know how much you’ll pay for coverage until you shop online and compare quotes from multiple companies. Still, the table below shows each state’s average annual auto insurance rates.

Average Annual Auto Insurance Rates by State and Coverage Type

States Average Annual Liability Coverage Rates Average Annual Collision Coverage Rates Average Annual Comprehensive Coverage Rates Average Annual Full Coverage Coverage Rates

North Dakota $283 $252 $113 $741

South Dakota $289 $251 $110 $1,206

Iowa $293 $251 $231 $819

Wyoming $323 $270 $223 $817

Maine $334 $332 $147 $1,078

Idaho $337 $285 $118 $833

Vermont $341 $278 $118 $738

Kansas $342 $255 $130 $904

Nebraska $349 $294 $117 $1,058

North Carolina $358 $227 $228 $738

Wisconsin $360 $210 $126 $696

Indiana $372 $207 $172 $672

Alabama $373 $299 $146 $818

Ohio $376 $298 $202 $941

Arkansas $381 $305 $183 $869

Montana $388 $224 $206 $779

New Hampshire $393 $365 $123 $1,354

Tennessee $398 $290 $136 $824

Missouri $399 $255 $200 $843

Virginia $413 $265 $130 $808

Illinois $431 $237 $115 $725

Mississippi $437 $260 $166 $825

Minnesota $440 $303 $195 $935

Oklahoma $442 $212 $90 $856

Hawaii $458 $209 $111 $657

New Mexico $462 $358 $157 $1,300

California $463 $365 $99 $927

Utah $471 $254 $107 $832

Colorado $477 $263 $158 $899

Arizona $489 $259 $184 $932

Georgia $491 $298 $100 $856

Pennsylvania $495 $377 $122 $1,219

South Carolina $498 $200 $229 $718

Texas $498 $341 $187 $1,026

West Virginia $501 $319 $195 $1,016

Kentucky $519 $391 $209 $1,327

Alaska $547 $360 $141 $1,049

Oregon $553 $307 $132 $934

Washington $569 $250 $104 $923

Massachusetts $588 $383 $147 $1,252

Maryland $599 $359 $129 $1,075

District of Columbia $628 $449 $230 $1,308

Connecticut $634 $349 $126 $1,109

Nevada $647 $282 $103 $778

Rhode Island $720 $248 $165 $911

Michigan $722 $214 $173 $827

Louisiana $727 $249 $97 $680

Delaware $777 $297 $113 $1,186

New York $785 $265 $123 $745

Florida $845 $320 $154 $965

New Jersey $866 $267 $167 $897

Read more:

- Buy Cheap North Dakota Auto Insurance

- Buy Cheap South Dakota Auto Insurance

- Buy Cheap West Virginia Auto Insurance

If you choose liability coverage, you can expect to pay lower rates for your insurance. But your vehicle will not be protected if you’re in an accident or if the damage is from a non-accident-related incident.

And even with a liability-only policy, you will pay higher rates if you do not garage your vehicle. You might also not get coverage if you cannot provide a permanent address.

The Impact of Garaging Misrepresentation on Insurance

If you lie about your garaging address, this is considered misrepresentation. Whether you misprinted the address on your paperwork, changed addresses during the length of your policy, or intentionally falsified your garaging location, garaging misrepresentation can be a big deal.

People who lie about their address do so to save money on their car insurance policy. For example, if you live in a bad part of town or a city with a high crime rate, you may be tempted to put a different address down as your garaging address.

But insurance companies don’t take this type of thing lightly. If you lie about where you park your car, you could have to pay high rates once your insurance company finds out. Your insurance company could also drop you as a policyholder for a breach of contract since you falsified information on your policy application.

In rare cases, you could face legal ramifications for lying about where you live or whether you park your car in a garage overnight.

Getting Car Insurance Without a Permanent Address

You’ll find it difficult to get car insurance without a permanent address. As stated earlier, companies determine your insurance rates partly based on where you live. So, not providing an address could make you a liability to an insurer.

Turning to a nonstandard company could be the best way to obtain coverage, but this will still cost you more money, and you can expect to get low coverage on your vehicle.

Avoid lying about your address on any car insurance application. It’s better to be turned down by a company and continue searching for coverage than to get in trouble for lying about your address and face the consequences.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Saving Money on Auto Insurance Without Garage Parking

If you have a permanent address but don’t have a garage, you can still save money on your car insurance premiums.

Car insurance companies offer a variety of discounts on coverage, including the following:

- Accident-free

- Safe driving

- Defensive driver

- Telematics

- Military

- Alumni

- Safety devices

- Good student

- Homeowner

- Multi-policy

- Paid-in-full

- Paperless

Discounts can save you up to 20% on your car insurance policy, so speak to a representative from any insurance company you’re seriously considering to see whether you qualify.

You can also shop online and compare rates from multiple providers to save money on coverage. Comparing rates allows you to find the companies in your area that provide the coverage you need at a price that works with your budget.

Auto Insurance Companies Without Proof of Garaging

Auto insurance companies that don’t require proof of garaging simplify buying auto insurance for drivers without a permanent parking spot. Despite varying rates, they offer competitive coverage options, and drivers can still access discounts like multi-policy or safe driver incentives to lower premiums.

Enter your ZIP code in our free tool to compare car insurance quotes and find the best rates from companies that don’t require proof of garaging.

Frequently Asked Questions

Why do some insurance companies ask for proof of garaging?

Insurance companies may ask for proof of garaging to determine risks like theft or vandalism, which can influence your premiums. Proof of residency for a Geico policy is sometimes needed to confirm your garaging address and ensure accurate pricing.

What is proof of a garaging address for securing low insurance premiums?

Proof of a garaging address, including documents like property tax bills or rental agreements, is essential. Providing proof of garaging address can help you secure lower insurance premiums if your parking location is considered low-risk.

What is a garaging address for insurance discount eligibility?

A garaging address for car insurance is where your vehicle is primarily parked, which insurers use to calculate risk. It can influence your eligibility for insurance discounts based on factors like local theft rates. Read more about “Auto Insurance Discounts: How Much You Can Save” to see how accurate information can lower your premium.

How does garaging location affect coverage options?

The garaging location, particularly the garaging ZIP code, affects insurance coverage by determining the risk of theft, vandalism, and environmental damage. A safer ZIP code may qualify you for better rates or additional discounts.

Find the best auto insurance rates without garaging proof by entering your ZIP code into our comparison tool.

What Progressive proof of garaging documents are needed for discounts or special rates?

Progressive typically requires documents like utility bills or lease agreements to verify your garaging address. Proof of garaging for Progressive helps determine eligibility for discounts or special insurance rates.

How do we prove a garaging address for high-risk drivers?

To prove a garaging address for high-risk drivers, you need documents like a utility bill or lease showing your address. Accurate garaging insurance details is crucial when buying high-risk auto insurance for proper coverage and premiums.

What is the most common source of insurance denials related to garaging addresses?

The most common source of insurance denials often involves failing to provide accurate documentation, such as what is proof of garaging. Misrepresenting the vehicle’s primary location can lead to coverage or rate denials, especially for liability coverage.

Does Progressive proof of garaging address affect lower monthly rates?

Progressive may require proof of a garaging address to assess risk and offer lower monthly rates. Parking in a safe location can lead to discounts or reduced premiums. For more tips, read about how to lower your auto insurance rates and understand the importance of proof of garaging address for Progressive in securing discounts.

Can you get car insurance without a permanent address?

Getting car insurance without a permanent address can be difficult, as insurers often require a garaging address. Understanding what a garaging address is, like garaging proof with Progressive, involves providing the location where your car is stored, even if it’s temporary.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.