Body Shop & Insurance

Many car insurance companies have preferred auto body shop companies, these shops make agreements with insurance companies in accordance with state laws to contract work and direct payments. If you are involved in a car accident and your car needs repairing, your insurance company may recommend that you use one of their preferred body shops.

However, despite the insurance companies’ suggestions, you are not required to use their recommended shops. Remember that you own your vehicle and have the right to choose where that vehicle is repaired.

While you have the right to choose where your vehicle is repaired, the preferred shops may offer a quicker repair process, given the existing relationship with the insurance company. You should weigh your options & choose the outcome that is best for you.

Any insurance policy is essentially a contract. You pay

a premium in exchange for a service, with certain requirements on the part of both the customer, you, and the insurer. You are the customer, and you are free to choose the best option for you. The purpose of this guide is to provide a helpful checklist for you at every step of the way, advising you how you can make sure that your claim is managed according to your terms.

Do I have to report an accident?

If you were in an accident, once the shock has subsided, it’s difficult to know what to do. Sometimes the temptation

is not to say anything and just drive off home. However, you are legally obliged (and sometimes contractually obliged by the insurance company) to report an accident:

*in some states it is required by state law and the insurance company policy to report all accidents

If it was your fault

If you caused the accident, then you are legally obliged to report it.

Once you’ve exchanged insurance details with the other party or parties, you’ll need to call your own insurance company and give them the information on the crash.

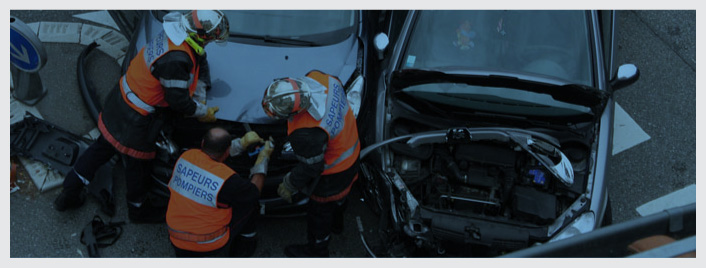

If someone was injured

Of course, if the person is seriously injured, then your first priority will be to get them medical attention. You should call 911 if you are in any doubt as to someone’s health situation.

In less severe cases, if someone was injured in the crash, medical bill coverage and liability car insurance coverages become involved and the claim becomes more complex, so you will definitely need to report the crash to your insurers.

What is the value and cost of property damage?

While it varies by state, there is a monetary threshold for damages. If you did more damage than the threshold, you’ll need to inform the police.

The amount of damage can vary from $1,000 to $5,000 across the United States. You can also report an accident after a few days if the damage is more severe than it initially appeared.

Do I have to repair my car?

Not all accidents require a trip to the body shop. A small fender bender won’t require you to do anything unless you want to fix your car for aesthetic reasons. However, in some circumstances, you will need to. The most common five circumstances which require repairs as follows:

1 Structural damage?

If your car sustained heavy damage, and its structure has been compromised, then you will

need to take it into a body shop. Some examples of structural damage are chassis damage or air bag deployment.

2 Is the car safe to drive?

If the car no longer functions safely, then you are legally obligated to get it fixed before driving the vehicle. If your car does not have functioning brakes, lights, or steering, then a trip to a body shop is absolutely necessary.

3 Is there a loan on the car?

If your car is being financed by a loan, then you may need to have the vehicle repaired in the event the vehicle is not safe to drive. In the event your vehicle returns to the ownership of the bank for any reason, the bank may require the vehicle be repaired.

However, if your vehicle is leased, then the leasing company will require that you repair the vehicle before you return the vehicle.

4 Do you have physical damage coverage?

If you have comprehensive car insurance or collision coverage, then you will need to get your car repaired, or at the very least report the damage to your insurance company. If you do not report the damage, and your vehicle is involved in another accident, your insurance company may refuse to pay all or part of your claim, depending on your policy.

5 Do you want to report the claim?

If you file an auto insurance claim with the insurance company, then you should consider having it repaired. Reporting an accident may lead to your premiums going up, so you may as well get the repairs at that stage.

How do body shops work with car insurance ?

Once you decide you need (or want) to have your vehicle repaired, then you have a few different options.

Working with the insurance company is an easier option, but you do have the freedom to search for a different

shop and potentially save some money.

Go to multiple shops and get estimates

The first option is to take your car to multiple shops and get estimates. Obviously, if your car is totaled, or needs to be towed, this is not an option. Otherwise you should go to at least three body shops and compare price quotes.

Take it to a body shop and get the estimator to go there

If your vehicle is drivable, ask your insurance company if they have a drive-in appraisal service. This is often the fastest option. Remember that an appraisal only assesses the visible damages, so may not be an accurate assessment of the total damages. Many body shops will require that you have an appraisal completed before scheduling a repair.

If your insurance company does not participate with drive in appraisal services, ask your insurance company to appraise your vehicle at a location convenient to you – home, work, etc. This option takes more time, due to the nature of the assignments. It is also more expense for the insurance company, and therefore not the preferred method.

Agree on a limit with the shop

Be careful to keep the body shop on target. The shop may find other damages, unrelated to the accident, which would not be covered by your insurance. If the shop does find additional related damage during the repair of your vehicle, your insurance company will need to follow up with supplemental appraisals.

If the shop finds unrelated damages, be sure to notify the shop in advance that you are only looking for the repairs documented in the appraisal.

Agree on a price with the insurer and the body shop

Once you have which shop will undertake the work, your insurer will agree on a price with the body shop based on the repairs identified in the appraisal. Once this has happened, you can sit back and let the body shop do the work.

Get a guarantee

Before you agree to the body shop starting work, you should get a guarantee for work done. Most body shops will offer a 30-day guarantee, so if anything goes wrong, you will be covered. Make sure to get this in writing before the work begins. Also, check with your insurance company. One benefit of using one of their preferred shops is that they may guarantee the shop’s work.

Do I have to use the body shop

the insurance company recommends?

The short answer to this is no, you don’t have to use the insurance company’s body shop. There are pros and cons of doing so. Before you agree to any work, you should consider the following.

-

It is only a recommendation

The insurance company may use language implying that you need to use their service. However, this is not the case (unless you have signed paperwork to that extent). Insurers obviously have their preferred service providers, but there is nothing to stop you from using a different service.

-

Find out what is needed

Your insurance will only cover damage that is related to the accident, and repairs that will return it to the state it was in pre-accident. Your insurer will not cover work that fixes pre-existing issues with your car, nor will they fix it to the standard it was when it was brand new. The appraisal will identify what will be repaired and covered by the insurance company.

-

It will make the process faster

One of the key benefits of using your insurers’ body shop is that the process will likely be much smoother. The channels of communication are stronger, and your insurer will trust the body shop. Your insurer may even guarantee their work. This simpler process means less work and less stress for you, the customer.

-

It can make things cheaper

Because of the relationship between the insurance company and the preferred body shop, there is often a greater understanding of what the insurance company will cover, and what they will not. That means that the body shop will be able to do more work without the insurer querying it. Preferred shops also have agreements with insurance companies to work within the rates approved by the insurance companies, which results in fewer out-of-pocket expenses.

What checks should I do before

driving away?

Before you accept the body shop’s work and drive away you should perform a thorough examination of your car. Once you leave the shop, it may be difficult to challenge any damages the shop may have missed. Examine the following items by sight and by touch.

Dent and Dust removal

If you brought the car in to have a dent fixed, then this should be the first place you check. Go through and feel the area that has been repaired. If the dent has been filled in with a lot of plastic filler, then they have cut corners and you will require more work in the future.

Instead, they should fix the dent as nearly as possible and use only

a small amount of plastic filler. Check also that all rust has been removed from the area before patching. Even a small amount of rust remaining can spread rapidly.

Corrosion Protection

Good body shops will re-add the protective coating to galvanized steel after they have undertaken bodywork. Bad shops won’t. The unfortunate aspect of this is that, after re-painting, it’s not possible to see the corrosion protection. However, if the paintwork is covered by a lifetime warranty, and then the bodywork starts to rust, you will be able to redo the work at a later date (and at a different shop).

Paint

The paint job is one of the first things that you’ll notice when it comes time to pick up the car. On newer cars, the paint should be an exact match in terms of color, and certainly in terms of thickness. If you notice that the paint has been applied too thickly, too thinly, or there is dust in the paint job, you should demand a repaint.

Drivability

Before you pull off the lot, take the car for a short drive to check that

it still works the way it did before. In particular, drive slowly forwards and remove the pressure from the steering wheel with your hands (but don’t remove them totally).

If the car pulls to either side, the wheel alignment is may be off, which can be extremely dangerous. An improper alignment may also lead to vehicle wear damage. You should also check the windshield wipers, the lights, the door handles, and the windows. Everything should be as before.

If in doubt

If you are in any doubt as to the condition of the car, don’t drive it away. Take photos, or make a video recording of anything you’re not happy with, and decline to remove it from the body shop. Speak to your insurance if you have any serious queries. They can send an investigator to deal with any major concerns. If your vehicle is at their preferred shop, they can intercede on your behalf.

Although car accidents can be traumatic and difficult events, the repair process need not be. Being without a car can be an inconvenience, and taking your car to a body shop you’re not familiar with can be an unnecessary hassle. However, you can make sure that the steps post-crash happen much more on your terms.

You are under no obligation to follow the recommendations of the insurance company. So feel free to shop around to make sure that you don’t end up paying too much out of pocket, or take your car to a body shop that you like. Your insurance company will ultimately cover the costs.

Certainly, working with your insurance company will mean the smoothest process, and may even end up saving money, although there is a number of pros and cons you should weigh up as relates to your situation. As long as you

remember that you are in charge of the situation, you can make sure that the outcome is best for you, and not just

for the insurance company.

Reviewed by:

Licensed Insurance AgentCynthia Lanctot

Where can I find sources and further reading?

- https://www.checkbook.org/national/auto-body-shops/articles/Dealing-with-Your-Insurer-When-Your-Car-Needs-Body-Repairs-2163

- https://www.carinsurancecomparison.com/can-i-pay-for-repairs-without-going-through-my-car-insurance/

- https://www.thebalancemoney.com/car-repair-following-insurance-claim-accident-527113

- https://www.badellscollision.com/blog/insurance-recommended-body-shops/