No Fault

Insurance

What Does It Cover, and What Will It Cost You?

No fault coverage is a coverage within on auto policy that provides coverage for medical expenses, rather than an actual type of insurance. If you have no-fault car insurance, your insurance provider will pay for your medical bills in an accident, no matter who was at fault. In this scenario, the other driver in the accident would be compensated for any medical bills by their own insurance provider.

No-fault insurance is a straightforward type of liability coverage

intended to lower legal fees in an accident.

When speaking collectively about this coverage, no-fault insurance most often refers to Med-Pay and Personal Injury Protection (PIP) in a car insurance policy, i.e. compensation for medical bills and lost wages. Standard no-fault insurance will not pay for the repair or replacement of a vehicle in an accident; this protection often falls under the collision portion of auto insurance policies. Read more in this article, “What is Personal Injury Protection (PIP) auto insurance?” to learn more.

A basic no-fault won’t do it all:

Medical Bills

There are limits to what is covered and how much of your medical bills will be paid; coverage may vary by state.

Property Damage Protection

In most states you will not be covered for the property damage with your no fault policy. It is recommended that you get a separate collision policy.

Lawsuits

No fault coverage does not prevent lawsuits from happening.

When a driver is at fault in an accident, it can result in higher

insurance rates.

for this reason

no-fault policies are beneficial to protect against rate increases triggered by an at-fault accident.

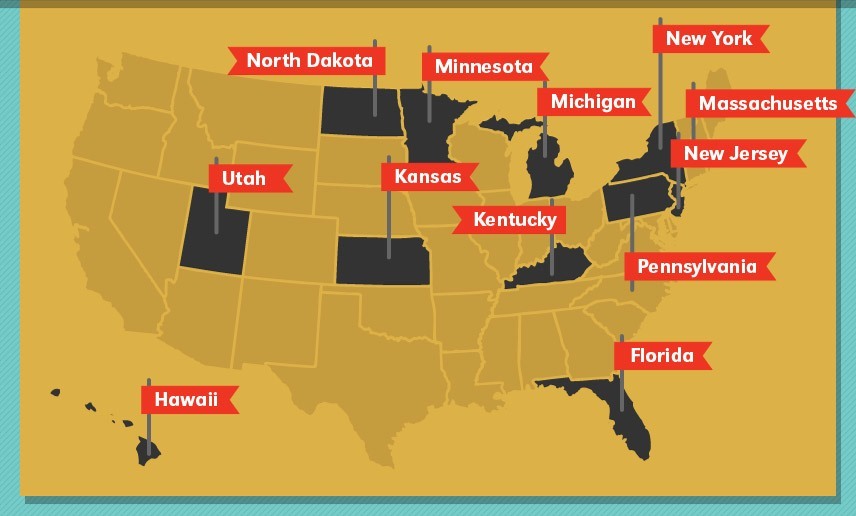

No-fault insurance states

PIP policies are mandatory in the following states

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Michigan

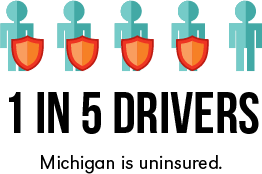

In a state like Michigan, no-fault insurance is required by law. If you are involved in an

accident without no-fault insurance, you could face up to one year in jail with a $500 fine:

Depending on the state, a no-fault insurance policy could provide protection for your entire family.

For all family members living under one roof, a no-fault policy will pay out personal injury protection (PIP),

Even if a family member is injured as a passenger in another vehicle or a pedestrian in an accident.

Of course, your level of no-fault car insurance will depend on your policy’s terms and conditions. In a perfect world, no-fault insurance should provide financial protection for both drivers in an accident. However, state minimums may not offer enough coverage for severe auto accident injuries.

Understanding your specific no-fault policy will better prepare you for the repercussions of an accident, no matter who was at fault. To protect against lapses in coverage, which we will discuss in the next section, you may choose to increase your personal injury protection under the no-fault portion of your auto insurance policy. PIP/MedPay coverage is typically state mandated and will apply to both commercial and personal policies (though if an employee is injured in the course and scope of his employer, Work Comp coverage becomes primary and PIP/MedPay will not apply, but he is injured in an accident outside of the course and scope (such as on a lunch break or running personal errands in a company car) then PIP/MedPay would apply).

Read more: Cheap Auto Insurance Companies That Accept Lapses in Coverage

What Will No-Fault Insurance Cover?

The 12 states listed above require no-fault insurance in order to legally drive a vehicle. In a no-fault auto insurance policy, it will provide coverage for:

Bodily Injury

Traditionally, when you buy liability auto insurance coverage, the other party’s bodily injury claims are paid for by your insurance company in an at-fault accident. In a no-fault car insurance policy, individuals will be protected in an accident with bodily injury coverage, regardless of who caused the crash.

Medical Expenses

A no-fault auto insurance policy includes personal injury protection to reimburse for hospital bills and related losses, such as disability and lost wages.

No-fault insurance is often used as a complementary portion of a full coverage car insurance policy. No-fault insurance may be packaged together with:

Limited Property Damage Insurance

A no-fault insurance policy can be used with a limited property damage liability, or mini-tort, policy to provide up to $1000 in liability damages, depending on the circumstance.

Collision Insurance

No-fault insurance will not pay for vehicle damage in an accident.

Comprehensive Insurance

No-fault insurance will not pay for vehicle damage caused by falling objects, weather, vandalism, etc.

There are specific areas that a no-fault insurance policy does not cover.

No-fault insurance is most often synonymous with personal injury and is not intended to cover vehicle or property damage. For this reason, no-fault insurance is often bundled with limited property damage, collision, and or comprehensive insurance, as listed above.

No-fault insurance will not cover:

Potential lapses in coverage may fall under the umbrella of traditional full coverage auto insurance. Vehicle theft is covered by comprehensive auto insurance; vehicle repair in an accident is covered by collision car insurance; pain and suffering may not be covered in an auto insurance policy whatsoever.

What are

the Benefits of No-Fault Insurance?

If your state requires no-fault insurance, there are benefits to be had in purchasing this type of coverage. First and foremost, no-fault insurance is intended to drive down extraneous legal costs associated with car accidents.

The benefits

- Less legal hassle after an accident.

- Total medical coverage in an accident, no matter who was at fault.

- All parties in an accident will be provided with medical coverage.

- Faster insurance claim awards after an accident.

- Protection against lawsuits, unless an accident caused serious injury or death.

The drawbacks

- No coverage for property damage or vehicle repairs, depending on the state.

- May only cover medical expenses up to policy limits.

- Won’t offer insurance coverage for pain and suffering.

- May drive up statewide insurance premiums.

- Innocent driver’s record may show history of an accident.

Bypassing small claims court may be reason enough to consider no-fault insurance. If you are involved in an accident with traditional liability insurance, it could cost you money out-of-pocket to settle the matter in court and get the damages owed to you. The time period for this complicated legal process could take months before it is resolved completely; no-fault insurance is intended to pay out monies owed immediately for medical bills and associated losses.

Read more about how auto insurance rates change after an accident in this article.

Since you won’t be responsible for paying the other driver’s medical bills, the total expense of the accident will drop significantly.

While financial savings may be a benefit of no-fault insurance for an at-fault

driver, this is precisely the reason that many drivers criticize no-fault policies.

A no-fault insurance system appears to penalize good drivers as it provides financial protection for bad drivers that have caused an accident.

If you live in a state that requires no-fault insurance, you may not have a choice in the matter. It can be advantageous to carry no-fault insurance if you accidentally cause a car accident. While no-fault insurance does have its share of criticism, in an at-fault accident, it can provide total coverage and offer quicker claim resolution to compensate for medical expenses of the injured person or persons.

How Much Will No-Fault Insurance Cost You?

Even though no-fault insurance laws are intended to reduce auto insurance rates by cutting down on legal expenses such as a personal injury lawsuit, some states are experiencing the opposite effect as medical costs jump through the roof. In Utah, PIP adds about $60-$100 a year to a policy.

One prime example can be found in the state of Michigan. In Michigan, mandated unlimited lifetime medical coverage coupled with a no-fault system has driven up the cost of auto insurance 35% higher than other nearby states.

It is for this reason that many states are pushing for no-fault insurance reform

Personal injury protection coverage in Michigan has jumped 230% within the past 12 years, compared to a mere 25% increase throughout the US.

In Michigan, you may pay as much as $1073 per year for a vehicle with no-fault insurance,

compared to as little as $669 in a state like Ohio:

-

Michigan (MI)

-

Illinois (IL)

-

Indiana (IA)

-

Wisconsin (WI)

-

Ohio (OH)

If Michigan is able to successfully reform their no-fault insurance policy by capping benefits paid to injured parties in car accidents at $1 million, it could lower no-fault insurance quotes drastically. Under this policy reform, the average family in Michigan is estimated to save $250 a year in auto insurance. This could mean a total savings of $125 per vehicle per year.

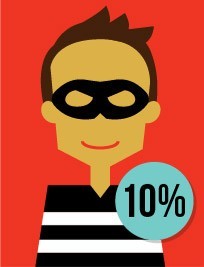

Many states believe that the best way to cut costs on no-fault insurance is by reducing personal injury fraud.

Up to 10% of car insurance claims made are fraudulent, which only compounds on rising insurance costs. The introduction of Fraud Authority in a state like Michigan or Florida will support the investigation and prosecution of car accident and related injury fraud to keep unnecessary expenses to a minimum.

If you want to keep your no-fault insurance costs low, there are several steps you can take:

Improve your driving record

By cutting down on traffic infractions and drunk driving convictions, you will reduce your risk of an accident in the eyes of an automobile insurer. A cleaner driving record and fewer insurance points mean you can buy cheaper no-fault car insurance rates, plain and simple.

Be patient

With age, comes experience – according to insurance companies. Simply waiting to pass important age markers, such as turning 25, can cause no-fault insurance rates to drop automatically when you are seen as a lower risk driver.

Consider moving

Insurance costs are often related to your geographic location. If you live in an urban area and take a long commute to work, you may have a higher risk of an accident compared to living in a rural area with a lower population.

Inquire about income restrictions

No-fault insurance will pay for lost wages in automobile accidents. If your income is below a certain bracket, or if you are retired and over age 60, you may be able to waive a portion of your coverage based on lower income requirements.

One of the most effective ways to keep cheap no-fault auto insurance, hands-down, is by

coordinating your auto insurance policy with your health insurance

By law, no-fault insurance is required to offer an auto insurance discount if you merge disability or health insurance benefits with a no-fault policy.

In effect, your no-fault personal injury protection coverage will only pay for medical bills and lost wages that aren’t covered by a disability or health insurance policy. This will make your no-fault coverage much cheaper compared to a regular no-fault policy intended to cover all medical expenses and related losses.

Though no-fault insurance seems like an excellent idea

in theory, it is losing popularity throughout the US.

24 states implemented no-fault car insurance as a means to reduce the number of unnecessary accident-related lawsuits filed in court.

Personal injury fraud and exorbitant medical fees have made no-fault insurance a difficult policy to embrace. Today, there are only 12 states with no-fault insurance. Many of these states are desperately seeking reform to keep no-fault insurance affordable for the average driver.