State Farm Auto Insurance Review in 2025 (Should You Buy?)

State Farm’s affordable car insurance rates and low complaint levels make it a top choice for many drivers.

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Jul 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

State Farm

Monthly Rates:

$86A.M. Best Rating:

A++Complaint Level:

LowPros

- Below-average rates for most drivers. State Farm has some of the cheapest car insurance rates in the nation and is a top choice for high-risk and young drivers.

- Strong overall customer satisfaction. Most policyholders have indicated that they received above-average customer service with State Farm.

- Large network of available agents. Customers who prefer to speak with someone quickly will find excellent service from State Farm agents.

Cons

- High rates for drivers with poor credit. State Farm drivers with poor credit rates are the highest among top insurers.

- No gap insurance is available. State Farm does not offer gap insurance, so you might want to look elsewhere if you have a large car loan.

- No new car replacement or vanishing deductible options. There is also no new car replacement option, and you will not be rewarded with a lower deductible for staying claim-free.

State Farm car insurance is an excellent choice for many drivers, especially for those with a not-so-perfect driving record who need high-risk auto insurance. Younger drivers will also likely find the cheapest rates with State Farm.

State Farm is the largest auto insurer in the industry, with over 100 years of experience. So you can rest assured knowing that you’ll have access to a multitude of coverage options and auto insurance discounts with a well-established company.

However, drivers with a poor credit history might find cheaper rates elsewhere. It is also worth noting that State Farm does not offer gap insurance.

While State Farm might make an excellent choice for you, every driver is unique, and we recommend that you shop around with multiple insurance companies before making your decision.

What You Should Know About State Farm Insurance

A top question readers ask is, “Is State Farm a good insurance company?” State Farm insurance reviews from customers and independent experts alike are good.

J.D. Power gave the company above-average ratings in customer satisfaction and State Farm auto claims handling. The State Farm rating from A.M. Best for financial stability is B, or fair — this score reflects a company’s ability to pay out claims. So, policyholders can feel secure with State Farm’s financial standing.

In addition, the National Association of Insurance Commissioners (NAIC) score indicated that State Farm auto insurance complaints were lower than the national average. Overall, State Farm has excellent ratings from customers and experts.

According to Quora user Matt Ostrowsky, a State Farm agent of 25 years, the company strikes an excellent balance between service, claims handling, financial stability, experience, and cost.

However, to see if the company is right for you, check out other State Farm reviews from customers, independent raters, and experts online through sites such as Quora, Reddit, and Consumer Reports. For instance, State Farm reviews on Reddit indicate that the company might not have the best rates for young drivers with speeding tickets. (Read More: How long does a ticket stay on your record?)

Another Reddit user claimed that while certain companies like State Farm, Allstate, and Liberty Mutual are more friendly to older clients who own homes and multiple cars, Geico and Progressive have better costs for drivers buying high-risk auto insurance.

According to State Farm insurance reviews with the BBB, or the Better Business Bureau, the company has an average of 1.19 out of 5 stars, with 1,586 customer reviews. In addition, the company has a C- rating from the BBB. On BBB’s customer State Farm reviews, complaints from customers usually talk about poor claims handling and customer service.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Insurance Coverage Options

Drivers with State Farm have almost all of the common types of car insurance coverage available to them.

Here is a list of all of the different auto insurance options State Farm offers:

- Property Damage Liability: Pays for damages to someone else’s property from an accident for which you’re at fault.

- Bodily Injury Liability: Pays for the other party’s bodily injury, damages or death from an accident when you’re at fault.

- Collision Car Insurance: Pays for damages to your vehicle due to an accident, no matter who’s at fault.

- Comprehensive Car Insurance: Covers your vehicle damage caused by theft, vandalism, flood, fire, or other incidents not involving a collision.

- Medical Payments: Covers your medical expenses resulting from an accident.

- Personal Injury Protection (PIP): Pays for medical treatment, missed wages, and other accident-related expenses.

- Uninsured/Underinsured Motorist Coverage: Helps to cover your injuries or property damage caused by another driver with no insurance or insufficient insurance.

State Farm also offers emergency road service, rideshare auto insurance, and classic car insurance.

What do those letters on your car insurance card mean? And do you have the coverage you think you have? Learn more here: https://t.co/f95MbXMuEq pic.twitter.com/39h0qy6t3U

— State Farm (@StateFarm) February 1, 2023

Does State Farm offer gap insurance? State Farm does not offer gap coverage. So if you have financed a brand new vehicle and need extra protection on your loan, you might want to consider a different company that offers gap insurance.

Other Services Offered Through State Farm

State Farm offers policies not only for your sedan and truck, but also for motorcycles, ATVs, RVs, and boats.

Below is a list of additional auto insurance benefits offered by State Farm:

- Roadside assistance

- State Farm bill pay, online quotes, customer portal, and paperless management

- Online claims submission and tracking with 24/7 availability

- Steer Clear app

- State Farm mobile app

With the State Farm mobile app, you can manage your insurance policy, access your State Farm insurance card, pay bills, request roadside assistance, and file a claim.

In addition to auto, State Farm offers these policies:

- Homeowners and renters insurance

- Commercial auto insurance

- Condo and co-op insurance

- Mobile home insurance

- Pet insurance

- Life insurance

- Farm and ranch insurance

- Umbrella insurance

- Disability insurance

Bundling your policies will save you additional money, and any State Farm agent will be happy to help you bundle and save.

State Farm Insurance Rates Breakdown

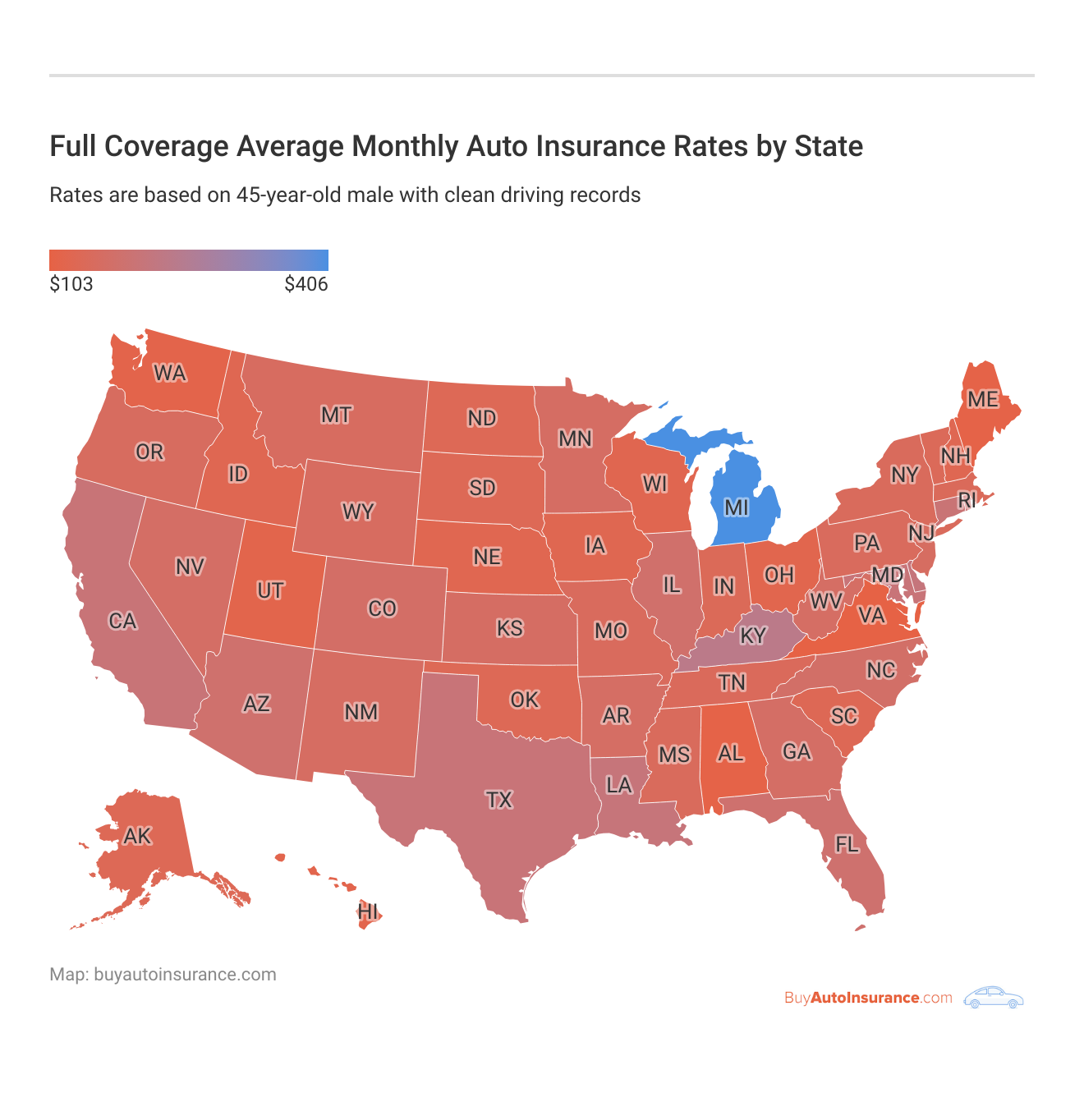

State Farm is one of the cheapest car insurance companies in the industry, with an average annual rate of $1,267 — $275 lower than the national average. However, rates vary due to several factors, including location and driving record, meaning a driver with State Farm insurance in Michigan pays different rates than a driver with State Farm in West Chester, PA.

To see how insurance rates vary across the country, take a look at the map below.

However, keep in mind that several factors come into play when deciding your car insurance rates. Everything from the types of car insurance you chooses to your age to your driving history will play a role in how insurance companies set your rates.

We go into more detail in the sections below about how much you can expect to pay for insurance, depending on your unique situation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Minimum Coverage Auto Insurance Rates

The minimum auto insurance required by state varies, but almost all states require drivers to carry a minimum liability coverage, and some require personal injury protection, medical payments, and/or uninsured motorist insurance.

Liability auto insurance does not cover your vehicle, but it pays for other drivers’ damages in an accident you cause.

Currently, State Farm has the third-lowest minimum coverage rates, falling behind only Geico auto insurance and USAA auto insurance. Take a look at the table below to compare State Farm and other liability rates with those of other top insurance competitors.

State Farm’s minimum liability insurance costs around $1,191 per year on average, with the national average being $1,463, a difference of over $260. However, your actual rates depends on various factors, such as location, driving record, and demographics. So, rates for State Farm in Las Vegas, Nevada will be different than for State Farm in Elizabeth City, NC.

State Farm Car Insurance Full Coverage Rates

Full coverage insurance with State Farm will typically cost you more than minimum coverage, but it also covers more. Full coverage auto insurance includes not only liability coverage but also collision and comprehensive.

State Farm has the fourth-lowest average rates for drivers with full coverage at $1,348 annually. The table below shows how State Farm stacks up against other top insurance companies.

State Farm’s rates are nearly 17% lower than the national average of $1,621.

Cost of Auto Insurance With State Farm for Teens

One of the most significant factors that influence rates is age, and adding a teenager to your policy can cause your premium to skyrocket. However, State Farm is a great choice for auto insurance for teenage drivers and has some of the best rates for parents adding a teen to their policy.

State Farm has the lowest rate increase among its top competitors for teen drivers, but the rates will always be highest for these young, inexperienced drivers.

This table shows how State Farm beats out the competition when it comes to teenage drivers.

The average rate for guardians adding a teen driver to their State Farm policy is $1,003 per year. This is substantially lower than even GEICO’s $1,958 — a nearly $1,000 difference.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of State Farm Car Insurance for Young Adults

State Farm has relatively low rates on auto insurance for young adults between the ages of 18 to 25.

On average, drivers will see their rates gradually decrease until reaching 25 years old, and then rates start to level off. This is because younger drivers tend to have more accidents even after exiting their teenage years.

State Farm’s rates for young adults are still below the national average at $2,407 per year. Below are the rates for young adult drivers with State Farm compared to rates from other insurers.

On average, Geico is another affordable option at $1,783 per year for young adult drivers.

Cost of Car Insurance With State Farm for Senior Drivers

Most drivers will see their rates stay relatively consistent through their 30s, 40s, and 50s. When drivers reach age 65, they may notice their rates going back up.

State Farm offers relatively good rates for auto insurance for older adults at an annual average of $1,423. Below we compare this with top competitors in the industry.

Again, Geico also provides some of the lowest rates for senior drivers at $1,197 per year.

Both State Farm and Geico offer some of the most affordable car insurance rates to drivers of all ages.

How Driving History Affects Your State Farm Rates

Your driving history is an essential factor in determining your auto insurance rates. Drivers should always expect their rates to increase after an accident or traffic ticket.

Good news: these drivers with a not-so-perfect driving record might find a cheap State Farm insurance quote. State Farm offers the second-cheapest insurance rates for drivers who have a speeding ticket on their record at $1,607 annually.

This table shows how State Farm ranks with its competitors in regards to single traffic ticket rates.

Average Monthly Auto Insurance Rates for the Top Insurance Companies for Drivers with a Traffic Ticket

| Insurance Company | Rates with a Ticket | Rates with a Clean Record |

|---|---|---|

| $108 | $91 | |

| $132 | $82 | |

| $144 | $107 | |

| $156 | $120 |

| $180 | $116 | |

| $192 | $109 | |

| $204 | $140 | |

| $228 | $166 | |

| $240 | $177 |

| National Average | $156 | $123 |

In addition, State Farm should be on the top of your list if you’re shopping for decent car insurance rates after an accident. State Farm ranks number one when it comes to the most affordable rates after an accident at just $1,713 annually.

Average Monthly Rates for the Top Insurance Companies for Drivers with an Accident

| Insurance Company | Rates with an Accident |

|---|---|

| $237 | |

| American Family | $166 |

| $198 | |

| $132 | |

| $236 |

| $165 |

| $190 | |

| $107 | |

| $157 | |

| Average | $176 |

Drivers with a DUI on their record will see the largest increase in auto insurance rates.

Again, State Farm has the cheapest rates for these high-risk drivers. State Farm drivers who need auto insurance after a DUI pay an average of $1,942 per year. This easily beats out the second-lowest insurer for DUIs, Progressive, by nearly $500.

4788-Rates-for-Top-10-Auto-Insurance-Companies-for-Drivers-with-a-DUI-created-72922-2022-08-29.csv

| Insurance Company | Rates with a DUI |

|---|---|

| $303 | |

| $177 | |

| $191 | |

| $213 | |

| $325 |

| $252 |

| $146 | |

| $124 | |

| $230 | |

| Average | $218 |

Even though State Farm ranks top in many national averages for risky drivers, remember to always compare quotes from multiple insurers. Just because an insurer ranks first on a national level does not mean it’s the best choice in your state or for your unique needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Credit History Affects Your State Farm Quote for Car Insurance

In contrast to State Farm’s cheap rates for drivers with less-than-stellar driving history, its rates for drivers with poor credit are the highest among the top insurance companies.

Insurers take credit scores into consideration when determining rates because there is a statistical link between good credit and good drivers. Drivers with good credit are less likely to file claims, according to most insurers.

State Farm has the highest rates on our list for auto insurance for drivers with bad credit histories.

Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Geico | $148 | $100 | $82 |

| Nationwide | $165 | $132 | $120 |

| Travelers | $194 | $127 | $107 |

| State Farm | $200 | $117 | $90 |

| American Family | $203 | $136 | $116 |

| Progressive | $206 | $137 | $109 |

| Farmers | $269 | $161 | $139 |

| Allstate | $296 | $196 | $166 |

| Liberty Mutual | $357 | $226 | $176 |

| Average | $226 | $148 | $123 |

Also, not all states allow insurance companies to use credit history when determining rates. California, Hawaii, Massachusetts, and Michigan have passed laws banning this practice.

With so many factors affecting how each insurance company creates its own rates, getting at least three insurance quotes from different companies is always recommended to find the best fit for your needs. That way you can compare State Farm auto quotes against others to ensure you’re getting the best price.

State Farm Insurance Discounts Available

State Farm offers many car insurance discounts to policyholders. Some of the most common discounts available are the good driver discount, vehicle safety discount, multi-policy discount, and anti-theft discount. For instance, you could qualify for a anti-theft discount for using a steering wheel lock or car tracking system.

View this post on Instagram

Let’s take a look at the discounts offered by State Farm:

- Accident-Free or Safe Driver Discount: If you drive without an accident for three years, you can qualify for an accident-free discount from State Farm.

- Good Student Discount: If a student is age 16 to 25, is going full-time to high school or college, and has a 3.0 grade point average, they can save up to 25% with State Farm.

- Loyal Customer Discount: Insure more than one vehicle with State Farm; you could save as much as 20%.

- Multi-Policy Discount: Insure a home or condo or sign up for life insurance or renters insurance alongside your auto insurance policy, and you can save up to 17% for bundling insurance policies.

- Defensive Driving Course Discount: Take a defensive driving class, and you may be eligible for a 10% to 15% discount with State Farm.

- Driver Training Discount: If drivers under age 21 complete driver training, they can get a discount.

- Student Away at School Discount: If one of the drivers of your vehicle is a student under age 25 who moves away to go to school, you may be eligible for a discount.

- Anti-Theft Discount: You may qualify for a discount if your car has an alarm or another anti-theft device.

- State Farm Drive Safe and Save: State Farm’s usage-based program offers drivers who participate a 30% discount on their policy. This program can operate through an app on your phone or through OnStar.

These discounts can help drivers lower their car insurance rates significantly since you are able to bundle several discounts on top of one another.

State Farm Drive Safe and Save has lowered my bill by $53 each month. This telematics program monitors driving behavior and awards a car insurance discount for safe driving. So, instead of paying $137 for full coverage, my rates are only $84 per month.

Daniel S. Young Insurance Content Team Lead

Remember that not all these discounts are available in every state. Make sure to contact a State Farm agent to clarify which discounts are available in your area and which may apply to you.

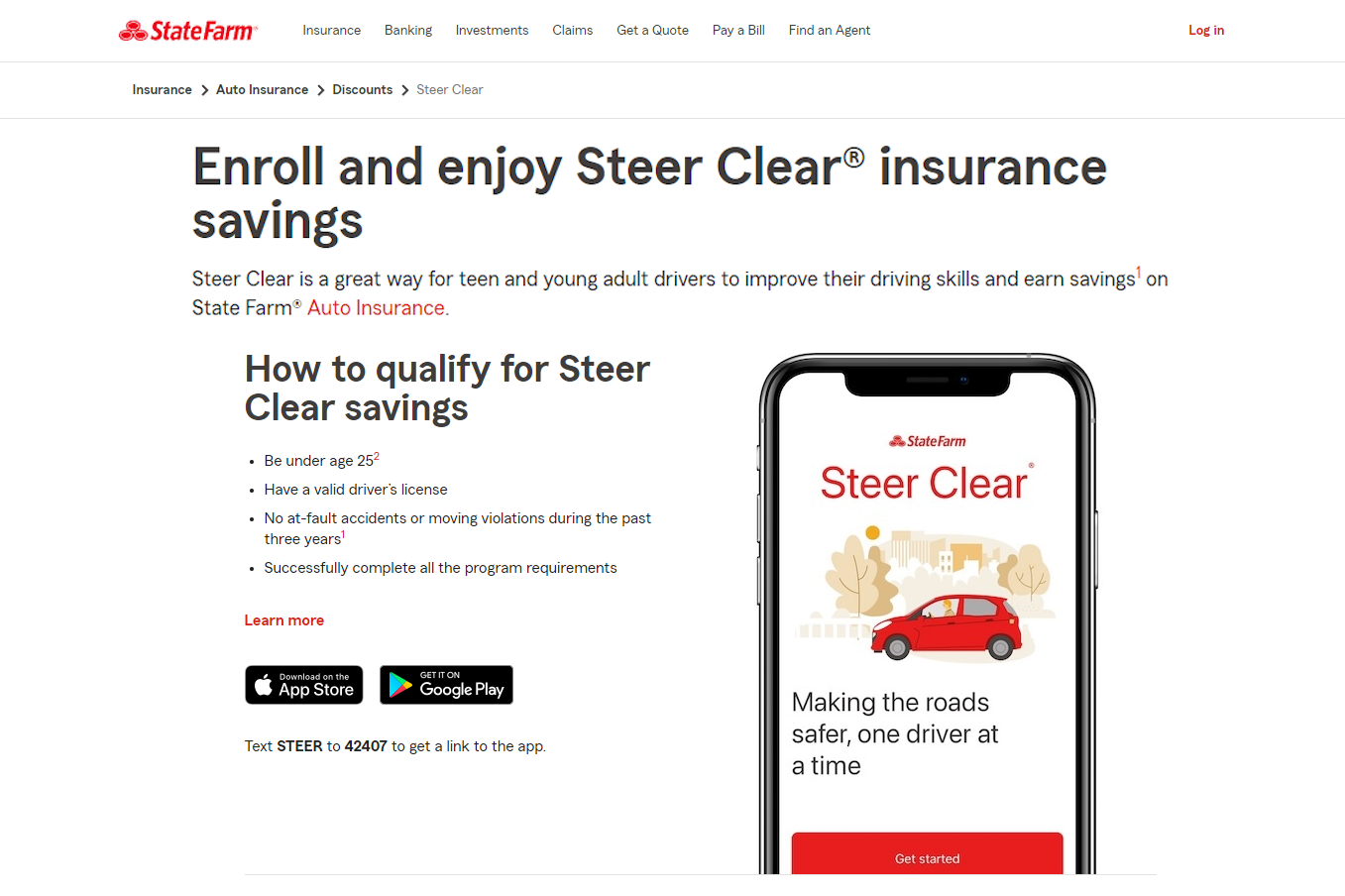

How to Save With the State Farm Steer Clear Program

Another opportunity for young drivers to save with State Farm is by taking advantage of the company’s Steer Clear app.

Drivers under 25 years of age with no at-fault accidents for the past three years are eligible to participate in the State Farm Steer Clear program. This app provides five training modules that consist of driving scenarios, lessons, and quizzes for the driver to complete within six months.

After completing this program, young drivers may be eligible for additional discounts — which is crucial since rates are highest for young, inexperienced drivers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Charitable History

Over the years, State Farm has created its own charitable organizations to help those in need.

State Farm’s charitable efforts include:

- The Neighborhood of Good: This organization was created to allow people to volunteer for causes in their neighborhoods close to their homes and hearts.

- The Good Neighbor Citizenship Company Grants: This is another community-based volunteer effort to help neighborhoods build safer, stronger, and smarter communities.

- State Farm Companies Foundation: This organization provides grants, scholarships, and other programs to support various volunteer groups.

State Farm has also partnered with various organizations to promote auto and home safety. Some of these organizations include the Insurance Institute for Highway Safety and National Fire Protection Association.

In late 2018, State Farm also launched State Farm Ventures. This unique program focuses on investing in tech startups with the goal of helping these companies improve customer satisfaction.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is State Farm good car insurance?

Many readers ask, “Is State Farm car insurance good?” Yes, State Farm is a good provider with excellent reviews from customers and experts. Whether you need State Farm in Topeka, KS or State Farm car insurance for a 19-year-old, you’ll get good service and affordable rates.

Is accident forgiveness offered by State Farm?

No, State Farm doesn’t provide accident forgiveness insurance. Accident forgiveness means that your rates won’t increase because of one at-fault accident.

What is State Farm’s A.M. Best rating?

In 2024, A.M. Best announced a State Farm rating change from an A, an excellent rating, to a B, a fair rating. A.M. Best said it downgraded State Farm to a B because of deteroriated financial reserves and worsened financial health.

Why is State Farm insurance going up?

Many customers have been asking, “What is going on with my State Farm rates?” In recent State Farm news, top reasons for higher rates include inflation, rising repair costs, and personal factors.

In addition, State Farm is losing money, as it reported a $6.3 billion net loss in 2023. So, the company could be raising rates to make up for losses.

Is new car replacement offered by State Farm?

No, State Farm does not provide new car replacement coverage. New car replacement coverage replaces a vehicle with a new vehicle of the same make and model if the car is totaled.

Is gap insurance offered through State Farm?

No, you can’t get gap insurance with State Farm. This type of insurance kicks in when you total a car and you still owe money on a loan.

Is a diminishing deductible program offered through State Farm?

State Farm also does not offer a diminishing auto insurance deductible. Insurers with this option will reduce drivers’ deductibles every year in which they don’t file a claim.

Is SR-22 insurance offered by State Farm?

Yes, State Farm offers SR-22 insurance certificates. Often required by states for high-risk drivers, SR-22s prove to the state that you have purchased car insurance coverage.

Is there a usage-based insurance option with State Farm?

State Farm offers a usage-based insurance program called Drive Safe & Save. Drivers who participate can receive up to a 30% discount on their policy. This program can operate through an app on your phone or through OnStar.

Why is State Farm so expensive?

State Farm policyholders may be wondering, “Why is State Farm car insurance expensive?” State Farm could be higher due to personal risk factors, such as location, driving record, or credit score. However, State Farm is generally a cheaper car insurance company.

Does State Farm have accident forgiveness?

While State Farm may have cheaper rates for drivers with accidents, you can’t get an accident forgiveness policy with State Farm.

Is Farmers Insurance and State Farm the same?

No, Farmers and State Farm are two separate companies.

Is State Farm losing customers?

State Farm has had difficulty keeping policyholders due to higher rates resulting from more claims payouts, particularly in a competitive insurance market.

Does State Farm offer roadside assistance?

Yes, you can add roadside coverage to your State Farm insurance. However, this State Farm policy change will increase your rates, so consider whether the coverage is worth the cost for you.

Should I use State Farm Select Service?

Yes, we recommend State Farm policyholders use the Select Service program, which is the company’s network of body repair shops. Select Service offers direct billing from State Farm to the repair shop for your claim, streamlining the claims and repair process.

Check out State Farm auto claims reviews for Select Service to see if the program is right for you.

Does State Farm offer health insurance?

While State Farm doesn’t have health insurance, you can get a Medicare supplement with the company. Check out State Farm health insurance reviews for its Medicare supplement policy online to see if policyholders are satisfied with their coverage.

While you can’t compare State Farm health insurance prices, you can enter your ZIP code into our free quote tool below to evaluate the cost of State Farm car or Medicare supplement insurance near you.

Is State Farm good at paying claims?

Yes, State Farm claims satifaction ratings are good. According to a 2023 J.D. Power study, State Farm ranked fifth in claims satisfaction with a score of 891 points out of 1,000, which is higher than average.

How do I contact State Farm customer service?

You can reach a State Farm agent by calling the customer service line at 1-800-782-8332.

Does State Farm use LexisNexis?

Yes, State Farm uses the LexisNexis system as part of its underwriting process.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

NaDu

Run from State Farm, they are not what they use tobe!

StateFarmAgentComplaint

IRRESPONSIBLE INSURANCE AGENT

JSmithElCajon

Incompetent [REDACTED NAME] [REDACTED NAME] of State Farm

SJF

Loyalty doesn’t pay with Statefarm they could careless

Chopper407

Two thumbs down for the claims department.

trailrunner87

Excellent Insurance Experience with State Farm

Ann_Smith

To "Insure" a downfall

romomy

Ridiculous Rate Increases

Jen Anders

State Farm Insurance review

LHN

Personal article policy