Collision Car Insurance

What Does It Cover, and What Will It Cost You?

What Is Collision Car Insurance?

Just as the name suggests, collision insurance covers the cost of repair or replacement of your car in the even it is damaged in an accident. Collision coverage will reimburse these damages even if you are at fault in a crash.

Collision car insurance can seem complicated

Depend on

Full Coverage Policy

Depending on your state regulations, a full coverage policy may include medical fee reimbursement in addition to coverage for the repair or replacement of your vehicle.

If you have health insurance policy

If you have a dependable health insurance policy, you may choose to drop optional medical expense coverage as part of your collision insurance package. Please check with your state requirements before making that choice. You may also want to check your health insurance policy language regarding auto related injury.

If you do not have health insurance

If you don’t have health insurance, and if your current insurance policy doesn’t cover medical fees, you could be faced with a pile of costly medical bills after an at-fault accident.

-

Ambulance transportation

-

Hospital stay

-

Emergency surgery

-

Prescription medications

-

Follow-up care

Auto collision insurance will pay for accident-related vehicle damages in an at-fault crash, after you have paid your deductible.

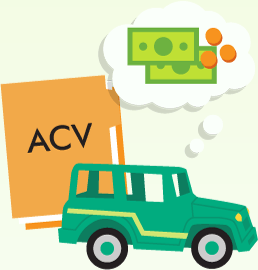

Depending on the deductible amount you set in your policy, ranging on average from $250-$1000, your collision coverage will pay out the remainder in damages and vehicle replacement – up to the actual cash value of your car.

For this reason, it’s recommended to stay up-to-date on the actual cash value (ACV) of your vehicle. Year after year, your vehicle depreciates. Your collision policy will be based on the ACV of your car, factoring in original purchase price and vehicle age and condition.

If you are still paying on your car loan or lease, it is possible for the ACV to drop below what you owe on the vehicle.

In this case, you will need GAP insurance added onto a collision policy to “bridge the gap” between the value of your car and what you owe on it. In an accident, GAP insurance will kick in after collision coverage runs out to keep you from paying thousands of dollars out-of-pocket to replace a totaled car. Keep in mind that not all Insurance Companies offer GAP insurance. You may need to consider separate insurance policy for GAP coverage.

Collision coverage is critical in an at-fault accident. If you get into a crash that is not your fault, the other party’s insurance company will pay for the damages.

How much collision insurance do you need? As a rule of thumb, industry experts recommend taking out collision coverage if your car is worth more than $4000. This is based on the Blue Book value, or actual cash value, of your vehicle

If your car dips below $4000 ACV, it may be more cost effective to cover your own replacement cost than to pay the annual premium, depending on your rates. Collision coverage on a low value vehicle could cost you more each year than total vehicle repair and replacement costs in an accident. If you are still paying off or leasing a new car, your lender will likely require you to carry collision coverage throughout the life of the loan or lease.

To review, you may need collision coverage if:

Your loan/lease terms

require it.

Your vehicle is worth more than $4000.

You don’t have enough money in the bank to pay for vehicle repair or replacement costs.

When you purchase collision coverage, the amount you pay each month will vary based on your deductible.If you opt for a lower deductible, such as $250 compared to $1000, it will raise your insurance premium each month, or vice versa. However, if you get into an at-fault accident with a lower deductible, you will pay less out-of-pocket for repairs and/or replacement.

Driving without the proper insurance coverage is not without its share of risk. While collision car insurance isn’t a requirement, it can certainly provide you with peace of mind every time you hit the open road. A serious traffic accident can cost you, especially if you are at fault or struck by an uninsured vehicle.

Depending on your driving demographic, you may be in an even higher risk category for an accident and in desperate need of collision coverage. Traffic accidents are the number one killer of older teen drivers. As a result, teenagers are saddled with the highest car insurance premiums in the nation, averaging 33% more than non-teen drivers.

Out of the 245 million cars in the US, one in seven is uninsured.*

Regardless of your age, start by determining how much car insurance you need and how much you can afford. Collision coverage can quickly pay for itself in an at-fault accident, especially when driving a newer vehicle. The better you understand your policy, the more you will benefit from your coverage.

It’s not until you’re in an accident that you may realize how much coverage you need.

-

If you rear end someone at a stoplight, collision coverage will kick in.

-

If you back into another vehicle in a parking garage, your collision policy will cover your damages.

-

If you hit a car after running a stoplight, your collision insurance will cover vehicle replacement if your car is totaled.

What Collision Car Insurance Does Not Cover

The average collision car insurance policy can vary by provider. It’s essential to become familiar with your policy’s terms and conditions before signing on the dotted line for an annual premium.

Although it may seem obvious that a collision insurance policy would cover any type of collision, your insurance provider may not consider some vehicle damages causes to fall under the umbrella of “collision” coverage.

To prevent any potential gaps in coverage, collision and comprehensive car insurance policies are intended to complement one another. Certain types of collisions may fall outside the realm of collision coverage. Some damage may be considered “comprehensive” in an insurance policy.

In most cases, a driver will hold both a collision and a comprehensive insurance policy to cover their bases.

-

An accident caused by an animal.

-

Acts of God

-

Weather damage from hail, rain, wind, etc.

-

Natural disasters

-

Fire damage

-

Riot damage

-

Theft/ vandalism

The good news is that if you have both a comprehensive and a collision policy, you’re fully covered.If you only carry a collision insurance policy, it is important to be aware of the areas that are not covered for damage or vehicle replacement.

If you only have collision insurance without comprehensive coverage, you will have to pay out-of-pocket if a tree branch falls on your car and crushes the roof of your vehicle.

Remember, Collision coverage applies regardless of fault.

If you are not at fault you can still use your collision coverage. There is a process called subrogation wherein the insurance company collects its payout from the at fault carrier. Most insurance providers will package comp/coll coverage in an auto insurance policy to protect against any type of vehicle damage, no matter the cause or who was at fault.

As mentioned above,

- If you are still paying on your vehicle loan or lease, both comprehensive and collision coverage may be required by your lender.

- If you own your vehicle in full, you are still required by state law to carry minimum liability auto insurance.

At this juncture, you may wonder if it’s worthwhile to continue paying for both collision and comprehensive insurance on your car.

Some insurance providers will make this decision for you. Your insurance company may have certain restrictions set on selling comprehensive and collision insurance separately.

Comprehensive-only policies are often limited to special circumstances, like classic cars that are driven rarely.

It is recommended to buy comprehensive coverage with a collision insurance policy.

If you decide to drop full coverage altogether, it is an entirely personal decision. But before you do, consider the potential expenses and cost associated with having to pay your own vehicle damages.

Is Collision Insurance Worth the Money?

No matter how you slice it, auto insurance certainly isn’t cheap. Your insurance policy will be priced based on a number of factors, including age, driving history, vehicle make and model, and even geographic location.

Yet based on the statistics below, car insurance made up only 2.19% of consumer expenses in 2009. Compared to other basic necessities and “extras”, car insurance is still likely to be cheaper than what you pay for your telephone bill each year:

How Auto insurance compares to other expenses

-

West

-

Midwest

-

Northeast

-

South

-

Sweets

-

TV – Audio

-

Auto Insurance

-

Telephone

-

1.88% of total expenditure

-

2.05% of total expenditure

-

2.35% of total expenditure

-

2.39% of total expenditure

Annual household expenditure in 2009

Source: US Bureau of Labor Statistics, published 2010

You can see the average prices of car insurance throughout the nation in the infographic above. Depending on where you live, you may pay close to $1000 a year in auto insurance premiums. Although it’s difficult to provide exact rates for average collision coverage since quotes will vary based on individual factors, collision insurance will take up a large portion of an annual premium.

The National Association of Insurance Commissioners released average auto insurance rates for annual 2010 premiums by state.

The total estimated premium included liability, comprehensive, and collision coverage in the examples listed below:

- $540Idaho

- $625Kansas

- $651Alabama

- $733Illinois

- $746California

- $848Texas

- $931Nevada

- $936Michigan

- $1,079New York

- $1,134DC

Collision insurance rates will vary by state.

The final rate that you pay for collision insurance will be determined by the amount of risk an insurance provider estimates that you will carry. This is precisely why certain factors like driving record, gender, type of car, age, and location are taken into account.

By far, one of the most effective ways to save money on collision insurance is by raising your deductible. However, it’s essential that you have enough money to pay the deductible amount in an at-fault accident, or you won’t receive any benefit from making this policy change.

After statistics are compiled, you will be given a collision insurance quote based on your risk category:

- Low Risk (Preferred driver)

- Average Risk (Standard )

- High Risk (Non-standard driver)

At this juncture, you may wonder if it’s worthwhile to continue paying for both collision and comprehensive insurance on your car.

-

Comparing insurance providers to find cheaper rates.

-

Researching the actual cash value of your car to determine when to keep or drop collision coverage.

-

Cutting out unnecessary policy extras, like rental reimbursement and roadside assistance.

-

Updating your insurance agent regularly about life changes that could impact rates, like getting married, moving, or buying a new vehicle.

Conclusion: How to Tell If Collision Car Insurance Is Right for You

Now to answer the burning question on your mind, the reason that you’re here today:

Is collision coverage right for you?

In a nutshell, you will benefit from collision coverage if you are still paying on a vehicle loan or lease – especially if full coverage insurance is required by your lender. However, once you pay off your vehicle, it’s time to focus on the actual cash value of your car.

You can consult Kelley Blue Book to determine the ACV of your vehicle. Once your car is more than eight years old, the amount you pay for collision insurance may no longer be worthwhile compared to the value of your vehicle.

Comparing your car’s ACV to your annual premium can help you determine if you are paying too much for unnecessary collision insurance.

Last but not least, consider how much you can afford in collision coverage. Even if you have an older car, many drivers prefer to pay a small monthly premium to protect their vehicle in the case of an at-fault accident. Otherwise, if you cause an accident, you will have to pay for vehicle repairs or replacement yourself – without any type of insurance protection

Before you make any final decisions in your policy, take a moment to put it in perspective.

Annual vehicle

ownership has risen

AAA estimates in their annual “Your Driving Costs” study that the total expense of annual vehicle ownership has risen to $9122 in 2013.

vehicle ownership cost factors

The biggest contributing factors to vehicle ownership costs are fuel, insurance, and depreciation.

maintenance costs increased

Insurance costs rose 2.76% from 2012 to 2013, while fuel costs climbed 1.93%, and maintenance costs increased by 11.26%.

If you can’t afford to pay for rising vehicle ownership fees out-of-pocket, a low cost collision policy may be your best bet.

Paying a monthly premium will protect you financially in the case of an at-fault accident. The rest of your money can be spent on vehicle necessities, like fuel, tires, and maintenance, to keep ownership costs affordable.

Reviewed by:

Licensed Insurance AgentCynthia Lanctot

sources

- “Car Insurance.” cdn.ownthedollar.com. Web. 15 July 2013.

- “Cost of Auto Insurance.” Auto and Homeowners Insurance Information for Colorado, New Mexico, Utah, Wyoming. Web. 15 July 2013.

- “The Real Cost of Vehicle Ownership.” www.cheersandgears.com. Web. 15 July 2013.

- “Uninsured Motorists, 2011 Edition.” insurance-research.org

- The information discussed should not be used as the sole consideration when selecting insurance. Confirm the best coverages through an agent or other authorized insurance representative.