Non-Owner Car Insurance

Protective Coverage Without Owning a Vehicle

Do You Need Car Insurance If You Don’t Own a Car?

Even if you only drive on occasion, you still need car insurance to protect you from legal liability when you get behind the wheel. If you don’t own a car and drive infrequently, non-owner car insurance may be right up your alley.

What gives?

With the myriad of insurance policies available for drivers in all circumstances, non-owner insurance often slips through the cracks. Nonetheless, you may need to buy non-owner auto insurance coverage because it’s an affordable option for occasional drivers that don’t own a vehicle yet still need protective coverage when they do drive.

The truth is that most drivers have never even heard of non-owner car insurance before

Non-owner car insurance uses may apply to non-owners that rent cars, borrow cars, or drive commercial vehicles for work sporadically

Even if you only drive from time to time, it is never worth the risk to drive without insurance. Non-owner car insurance fits the bill by offering affordable, limited-liability coverage so that you remain insured and legally protected whenever the opportunity to drive presents itself.

Insures the medical expenses of other drivers and passengers in an at-fault accident.

Non-owner car insurance will extend coverage for

Bodily Injury

Insures the medical expenses of other drivers and passengers in an at-fault accident.

Property Damage

Insures the repairs or replacement of another

vehicle/vehicles in an at-fault accident.

Similar to when you buy liability auto insurance coverage, non-owner insurance coverage will offer protection in an at-fault accident, i.e. an accident that you cause.

Non-owner car insurance will not provide coverage for any personal damages in an at-fault accident, such as to a borrowed or rental car that you may be driving. If you didn’t cause the accident, the other party’s insurance will be responsible for paying for medical expenses and damages to your vehicle (in most states).

Last but not least, don’t forget that non-owner car insurance is considered a supplemental policy when borrowing a car.

Can You Afford Car Ownership?

When you factor in the ever-increasing cost of car ownership and often expensive insurance rates, it makes sense that more and more drivers are choosing to forego vehicle ownership. If you live in a city with a good public transportation system, owning a car may be frivolous and unnecessary.

Around the globe, car ownership costs are running high

According to the Economist.com, Shanghai has been confirmed as the most expensive city in the world to buy and run a family car, when taking into account the cost of a new vehicle, road tax or registration, service without major repairs, insurance fees, and fuel costs for 10,000 miles annually over three years.

Other costly international cities that made the list include Sao Paulo, Rome, Berlin, and Amsterdam. New York City is considered a pricey city for vehicle ownership, although total car operation costs have dropped 8.1% when comparing 2005-2007 figures with 2010-2012 figures.

To put it in perspective, here’s a closer look at the cost of car ownership

Cost of automobile ownership

According to AAA, the average cost to operate and own your vehicle is 70.7 cents a mile which totals a whopping $5,925 annual average (if the car is driven 10,000 miles annually). The main components that contribute to the real costs of owning your car are*:

-

37.49%

Value Depreciation/$2,318

Although the low sticker price of a Kia or a Hyundai may look like a steal, over the long haul those vehicles have lower resale values than cars such as Hondas or Toyotas. According to Consumer Reports, after five years of car ownership and weighing the depreciation of the vehicles, Hyundais are not proven to be less expensive with comparable Honda’s models.

-

16.33%

Fuel Costs/$1,009

Fuel expenses total nearly one quarter of the total costs of car ownership. Regardless of the initial sticker price, over time, a gas consuming SUV will cost significantly more to own and operate then a gas “sipper” (based on average gas station cost of $2.30 per gallon).

-

15.78%

Auto insurance/$976

Insurance rates may vary according to your vehicle, car owner’s age, driving history, and location of registration and will fluctuate accordingly.

-

$257

Decreased Depreciation

This number differs from “value depreciation”. It is based on the annual wear and tear of your vehicle determined by miles driven.

-

-

12.60%

Financing Charges/$779

Ultimately what interest rate you are charged for financing your vehicle purchase works in direct correlation to your personal credit history.

-

1.25%

Tires/$77

Even the most careful driver can accidentaly drive over a nail. The average costs of tires is based on replacing the standard ones included on your vehicle.

-

7.38%

Maintenance and Repair/$456

Making sure your vehicle is maintained per the instructions of the owner’s manual is not only imperative for the life span of your car, but for the safety and well being of passengers.

-

9.17%

License, Registration

and Taxes/$567$567 annual average

*The following numbers are all annual averages

AAA estimates that the average cost of vehicle ownership and operation totals at $5,925 a year

This, of course, doesn’t take into account the actual purchase price of a vehicle. License, registration, and taxes may run you $567, added on to fuel costs at $1009, plus roughly $2318 in vehicle depreciation. Other expenses that factor into the total include financing charges, auto insurance, tires, and maintenance and repair.

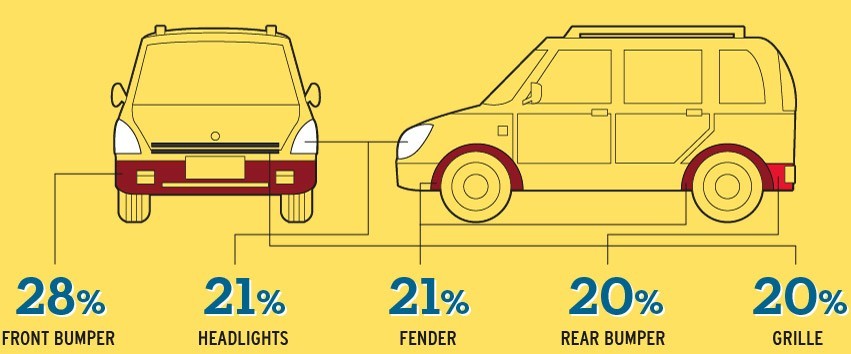

If you do decide that it is worthwhile to pay for and maintain a vehicle for necessary transportation, the expenses don’t stop there. If you get into a crash, no matter who is at fault, your vehicle is likely to be damaged. If you have limited liability insurance, you’ll be the one who has to pay for your vehicle damage and/or replacement in an at-fault accident.

Consider these frequently damaged car parts in a collision

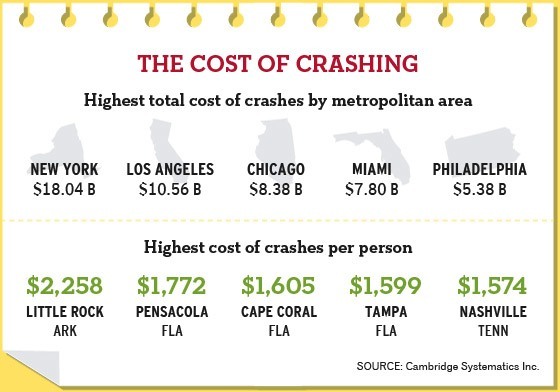

These commonly damaged car parts factor into the total cost of a crash and may

contribute to billions of dollars in damages throughout the US, as seen in the chart below

If you live in a city like Little Rock, Arkansas, a typical crash could run you an estimated $2250 out-of-pocket. In Nashville, Tennessee, these costs may drop to $1574 out-of-pocket – which still isn’t cheap.

In light of these sobering figures, you may decide that owning a car simply isn’t worth the hassle or the expense as an infrequent driver. If you have the means to take advantage of public transportation or borrow a vehicle periodically, personal vehicle ownership may no longer make sense.

A non-owner car insurance policy will offer liability coverage for a driver that doesn’t own a vehicle.

Liability coverage is necessary no matter how often you drive to protect you from legal vulnerability in an at-fault accident. Non-owner car insurance will only cover one driver for liability – not multiple drivers under the same policy.

Non-owner car insurance is also limited in that it won’t extend coverage to your personal vehicle if you own one. A basic non-owner policy won’t pay for your medical or vehicle damages; in some instances, extra personal coverage may be available as an add-on, depending on the insurance provider.

Who Is a Candidate for Non-Owner Car Insurance?

You may benefit from non-owner car insurance if you meet the following criteria:

-

You don’t own a car

-

You rent vehicles 10

or more days a year -

You sometimes drive

borrowed cars -

You occasionally drive

commercial vehicles

It’s critical to understand that non-owner car insurance does not provide coverage for your personal vehicle

If you own a car, you will need vehicle coverage from a traditional liability car insurance policy. Non-owner car insurance can be used for extenuating circumstances where you may drive another vehicle, whether it is borrowed, rented, or driven commercially.

In addition, if you often drive a car owned by a family member in your household, you will need to be listed as a secondary driver on their insurance policy.

In this circumstance, non-owner insurance will not apply since you regularly drive a borrowed car in your household. Non-owner car insurance can be used when you borrow a friend or family member’s car on rare occasions throughout the year. For more about “Does auto insurance cover borrowing a car” check out this article.

5 Advantages of Non-Owner Car Insurance

If you fit the bill for non-owner car insurance, there are several reasons to purchase a policy:

-

Liability protection for

drivers that don’t own a

vehicleIt’s impossible to predict when and if you will ever get into an accident. If you don’t own a car and borrow or rent on occasion, liability insurance is necessary to protect the other party in an at-fault accident. You can also be ticketed and fined for driving illegally without liability insurance in most states.

-

Prevent a lapse in insurance coverage

If you choose not to own a vehicle for a certain period of time, keeping your car insurance current can still be advantageous. When you shop for insurance after a lapse in coverage, you may be automatically considered a high risk driver since you went without coverage for a period of time. A non-owner policy will keep your car insurance current and provide continuing proof of financial responsibility, even when you don’t own a vehicle.

-

Provide rental car coverage

If you travel regularly for work and use rental cars, you can save money on buying rental car insurance coverage by utilizing your own non-owner car insurance policy. Non-owner car insurance will provide liability protection for you as a driver in a rental car in most states; purchasing a rental car collision damage waiver is recommended to insure potential physical damage to a vehicle.

-

Offer affordable urban car

insurance coverageAs mentioned above, if your city has a great means of public transportation, then there’s no logical reason for you to pay to own and operate a vehicle. Nonetheless, if you have a valid driver’s license, it is still important to carry some type of low-cost limited liability insurance when and if you choose to get behind the wheel.

-

Cover short-term liability needs

If you don’t own a car but work temporarily as a valet, for example, non-owner car insurance makes the most sense. However, it is important to review your policy terms and conditions to make sure a non-owner policy will provide adequate employment coverage. Or, you may need short-term liability coverage when driving a friend’s car to help them move cross-country; non-owner insurance can insure you as a temporary driver without personal vehicle ownership.

3 disAdvantages of Non-Owner Car Insurance

There are a few drawbacks to very limited non-owner car insurance. It’s important to understand from the get-go that non-owner insurance does not provide coverage for:

- A vehicle registered under your name

- A vehicle registered to another member of your household

- A vehicle titled to you as the owner

- Company vehicles

- Non-private passenger vehicles

- A borrowed vehicle that you drive regularly

Beyond basic limitations, some disadvantages of non-owner car insurance include:

-

No coverage for collision

A non-owner insurance policy will only provide liability protection in an accident, meaning your personal medical expenses and vehicle damages won’t be covered. Full collision auto insurance is needed to insure your personal damages in an at-fault accident.

-

No coverage for owned vehicles

A non-owner policy cannot be used for personal vehicles; basic liability insurance is intended to provide coverage for limited liability protection when driving a vehicle that you own. If you own a vehicle, you should try to buy full coverage auto insurance. This covers you in ways that non-owner coverage doesn’t.

-

No coverage for work-related vehicles

In some policies, non-owner insurance is limited when it comes to work-related driving. In many cases, a non-owner policy can be used when working as a valet or driving a vehicle cross-country for an auction; however, vehicles that are driven intermittently for business purposes may require someone to buy commercial auto insurance coverage.

How to Save Money on Non-Owner Car Insurance

One of the main reasons that so many occasional drivers are drawn to non-owner insurance is because of the affordable price tag.

If you don’t own a car and drive irregularly, there’s no reason to pay full price for even a basic liability auto insurance policy.

Non-owner car insurance rates will vary and may start at $400 per year on average.

State minimum insurance requirements can impact non-owner rates, up to an estimated $700 a year in a state like Illinois. Nonetheless, even if you fall on the high end of the spectrum, paying $700 a year in non-owner insurance adds up to only $58 per month. If your annual policy costs $400, you’ll only have to shell out $33 a month to drive legally whenever you borrow or rent a car.

DMV.org even estimates non-owner insurance as low as $200 per year.

If you’re looking for low-cost non-owner insurance, consider these helpful

tips before you sign up for a policy:

-

Compare a minimum of three providers to secure lower rates. We have an auto insurance calculator that can help.

-

Consult with an insurance agent to determine if non-owner insurance really is the cheapest option compared to basic liability insurance.

-

Keep your driving record clean to lower insurance rates automatically.

It’s important to remember that not every car insurance provider will offer non-owner insurance in lieu of basic liability coverage.

You may have to take extra time to research insurance agents that provide the non-owner coverage you’re looking for at an affordable price.

Once you sign up for a non-owner policy, make sure to read the terms and conditions in great detail

The entire purpose of a non-owner car insurance policy is to protect you as an occasional driver that doesn’t own a personal vehicle. If you get yourself into a situation as a driver where non-owner insurance doesn’t apply – such as driving a personal vehicle – you could be held liable for thousands of dollars in damages in an accident.