How long can you stay on your parents’ auto insurance?

- There is no time limit for you to stay on your parents’ car insurance

- Auto insurance rates are much higher for younger drivers, so staying on a parents’ insurance makes sense

- There are many reasons not to add your child to your auto insurance, including DUI and a poor driving record

When a young driver gets their first license, in the vast majority of cases, the best financial option is to put them on their parents’ car insurance. Indeed, some insurance companies will mandate insuring a child on their parents’ car. But how long can you stay on your parents’ auto insurance? We did a great deal of research to answer this question.

As housing costs increase, more and more young people are remaining at home rather than moving into their own housing. Additionally, many parents find themselves wondering, “How much does it cost to add a child to your car insurance?” and “What are the auto insurance rules for dependents?”

- According to the Pew Research Center, one-third of all 25-29-year-olds lived with either their parents or grandparents.

- By comparison, in 1970, one in eight 25-29-year-olds lived with their parents. This is having a number of effects when it comes to things like car insurance.

Having an adult child living at home raises the question of whether it’s better to keep them on their parents’ car insurance, or whether it’s better to have a separate policy. You may be wondering, “How long can a child stay on their parents’ car insurance?”

Easily learn about how long a child can be on their parents’ auto insurance, insuring a child on a parents’ car,and how to buy auto insurance when the time comes.

This guide will examine the financial pros and cons and outline the best option for all parties. Before answering the question of how long you can be on your parents’ auto insurance, compare auto insurance rates now by using our helpful tool and entering your ZIP code.

How long can you be on your parents’ auto insurance?

“How long can children stay on parents’ insurance?” is frequently searched online. So, how long can you stay on your parents’ insurance? There is no upper limit.

Can a 26-year-old be on a parent’s car insurance? Unlike health insurance, which has a cut-off at your 26th birthday, a child can stay on their parents’ car insurance for as long as they want, as long as they meet the other criteria for eligibility.

So, it’s possible to stay on your parents’ insurance until 30 or above. However, there are often related factors when it comes to the question, “How long can you stay on your parents’ insurance?”

Do auto insurance costs drop with age?

How much does it cost to add a 16-year-old to car insurance? Putting a teen driver on their parents’ car insurance is a financial no-brainer. Car insurance for teens is often extremely expensive, owing to the (relative) frequency with which they require a payout.

Insuring a child on a parent’s auto policy can be a financial burden for sure. However, as the young driver gets older, the cost of insuring them drops rapidly.

If you are a child on your parents’ car insurance and wondering at what age your car insurance coverage will get cheaper, read the section below.

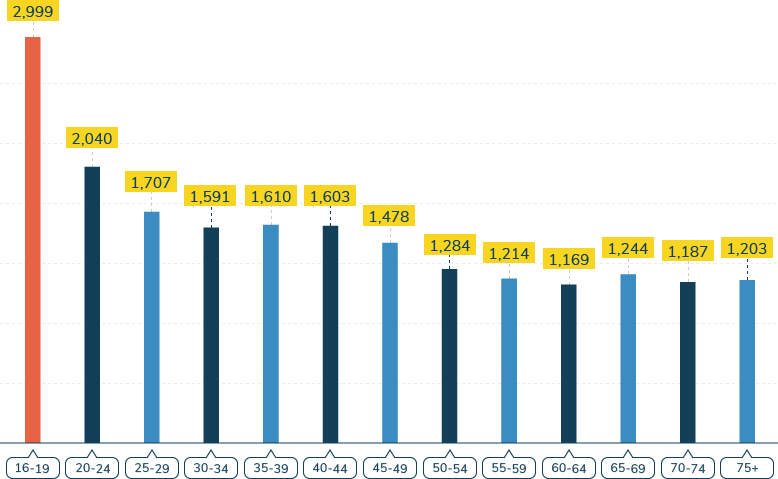

Average Per Year Insurance Rate ( $ )

Here is a more in-depth look at average car insurance rates by age.

How much does it cost to add a child to your car insurance? As the table above shows, the cost of insuring a driver drops rapidly after they hit 25. But how much does your insurance go down when you turn 25?

Of course, this will vary depending on other factors, although it may be the case that when a child hits a certain age, adding the cost of their own insurance to your insurance is more expensive than having two different insurance policies.

Many children themselves may be asking, “Can I get insured on my parents’ car?” You will need to crunch the numbers for your own individual circumstances, although as a general rule, the older the child, the more viable it will be to have them on their own insurance.

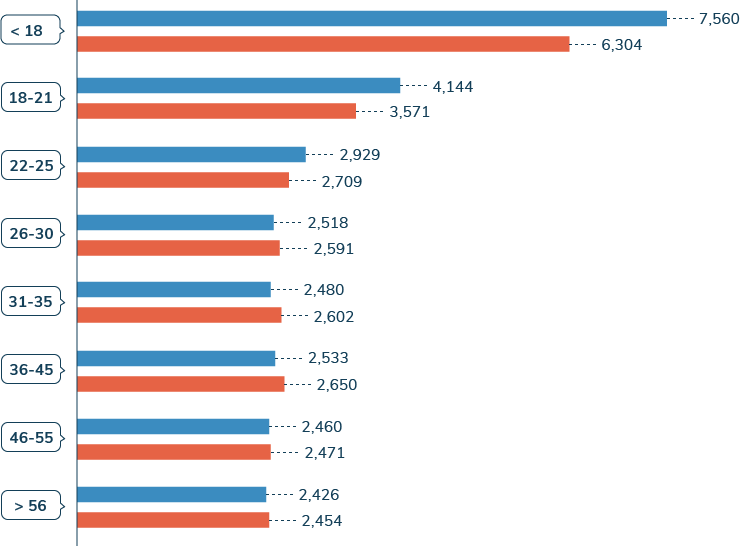

Is gender is a factor in auto insurance rates?

Along with age, gender plays a role in insurance costs. Young female drivers generally require fewer claims than young men, and, as a result, their insurance rates are lower.

THIS VARIES BY AGE, AS THE TABLE BELOW SHOWS

- Average per year rate for a male driver ($)

- Average per year rate for a female driver ($)

Again, gender is a key metric that will feed into the cost of your car insurance calculations, although the cheaper the person is to insure, the more feasible it will be to have them on their own insurance. Learn how your child’s living situation can affect rates.

Do all family members living in the same home have to be on the same auto insurance policy?

Aside from any of the financial considerations, you also need to examine the legal aspects of your decision.

For example, most insurance companies will require that you list all licensed household members on your car insurance policy, including your child.

The insurance company assumes that if you live in the same home, you are likely to use the same vehicles, and therefore it is compulsory for all residents to be listed on the same insurance policy.

Can a child stay on their parents’ auto policy if they move away?

A key issue comes if a child moves away from home. Although it may seem like that’s the time for them to get their own insurance policy, it may make financial sense for them to stay on yours. So, can you stay on your parents’ car insurance if you move out?

Insurance companies have slightly different criteria when they allow children who do not live at home to be listed on the policy.

You should be sure to check your contract and/or speak with a representative on the phone. Make sure to let them know if any of your children living away from home are college students; some auto insurance companies have different standards if your child is a full-time student.

What is considered financial independence?

Some insurance companies have a threshold for ‘financial independence’ once a child reaches the level of financial independence, they no longer allow for them to be on their parent’s insurance.

How they define ‘financial independence’ does differ from company to company, although what they have in common is that they usually see the following two as a threshold for financial independence.

Can you stay on your parents’ auto insurance if you own your own home?

If your child owns their own home or apartment, then an insurance company will consider them to be financially independent, and will no longer allow them to be on your insurance.

If they rent an apartment of their own, they have not yet met the threshold for financial independence. Similarly, if the home that they own is in your name, then you will still be able to have them on your own insurance.

Can you stay on your parents’ auto insurance after marriage?

Some children wonder, “Can I be on my parents’ car insurance if I’m married?” If your child gets married, then regardless of their financial position, they are usually considered to be financially independent.

So, can you be on your parents’ insurance if you are married? Under some circumstances, such as if they are still teenagers or still live in the home with their parents, the insurance company may not consider marriage to be a threshold (although you may need to put the spouse on your insurance).

Learn about the benefits for both you and your child of having them on your insurance policy.

First, you should check whether your child could be on your insurance. The next step is to determine whether they should be on your insurance.

There are some very clear benefits for a child to stay on their parents’ insurance, although you will need to weigh these against your own specific circumstances.

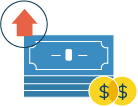

Is it cheaper to be on a parent’s auto insurance?

Is it cheaper to be on your parents’ car insurance? Without a doubt, being on a parent’s car insurance will be cheaper for the child (and not only because the parent will usually pay the bill). According to the Insurance Information Institute, for teen drivers, who are extremely expensive to insure, being on the parents’ insurance will decrease costs dramatically.

By sharing insurance, the insurance company will assume that you, the insured, will take on some of the risk and responsibility of your teen driver. The insurance company may also assume that the teen driver is likely to be using the car infrequently, so will adjust prices accordingly.

The insurance company essentially takes an average of the risk of the parent and the risk of the teen driver. Of course, this means that the parents’ rates will increase. Although, for the teen driver, this is often the only option that will be affordable.

How can you establish auto insurance history?

Much like credit, insurance companies look for a solid history of insurance when offering a policy. Having a child on a parent’s insurance fulfills this stipulation, and effectively allows the child to build up their own insurance history, thus reducing their premiums in the future.

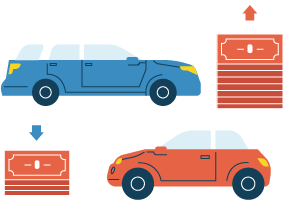

Can children with their own cars stay on their parents’ auto insurance?

If your child gets his or her own car and is still living at home you will have a financial decision to make. In this instance, you can choose whether to have the child on their own insurance or to keep them on yours.

What are factors you will need to consider (and your auto insurance company will certainly consider)?

What car your child buys (a cheaper car will be cheaper to insure, a sports car more expensive)

Your child’s driving history

The deductible (the higher the deductible, the cheaper the rate)

Your child’s age, as some insurance companies will not allow a minor to have his or her own policy

Before thinking about buying a car for your child, compare prices for insurance options. In general, the sweet spot for insurance is the combination of safety and price.

Buying an older, cheaper vehicle may save money, but an insurance company will (rightly) see it as less safe. A modern SUV will be safer but will cost much more.

When is it best to go it alone?

Although it varies greatly from family to family, there are certain times when it is certainly better for a parent to cut their child off from their insurance.

Or, to put it another way, there are certain times when not having your child on your insurance is definitely going to be cheaper. There are two main examples:

How does poor accident history affect auto insurance?

There are many factors that affect car insurance rates, and driving history is a big one.

If your child has a poor accident history then your insurance company may not allow them on your insurance or may refuse your policy application. In these instances, you have little choice but to get a separate insurance policy for your child.

However, this is likely to be expensive for your child, who will not be able to pool their driving history with yours to see a reduction in premiums.

In these circumstances, what options can you investigate for your child?

- Advanced driving lessons

- Certified course for driving

Both of these will help to make them a more attractive prospect for insurers.

How does a DUI affect your auto insurance?

If your child has a DUI then you are certainly legitimated in removing them from your insurance. Although it may have been a one-off incident, your insurance company will see them as a major risk, particularly if they are a teen driver.

Teen driver insurance rates for DUIs are more than double those of non-DUI teens, meaning you will be looking at a rate of roughly $4,000 according to the National Association of Insurance Commissioners. Your child may also have a short-term revocation of their license.

Even when the license is returned, a DUI can see insurance remaining high for a period of up to 10 years, so it might be the right time to tell your child to get their own insurance.

What school and college auto insurance discounts are available?

A gray area for parents and children is when children go off to college. They have their own address but, for all intents and purposes, they still reside with their parents. In these situations, insurance companies have a couple of options that can help you save money.

What is the college student auto insurance discount?

If your child is at a college more than 100 miles away from your home but wants to retain access to your car during vacations, most insurance companies will cover that.

The usual discount in these circumstances is around 50% because the company recognizes that the child will be unlikely to drive as often as when they lived at home.

What is a good student auto insurance discount?

Most insurance companies also have a discount for students who can maintain a GPA above 3.0. Students with stronger grade performance are less likely to crash, and therefore less likely to require an insurance payout.

<

When should you speak to a broker?

As this guide has shown, there is a wide range of options available, and it can be confusing to know which one is the best for you and your family.

The best course of action is to get as much information as possible.

Cost is only one factor – you will also need to take into account what the safest options are for your family. Although searching online can give you a quick view of the prices and options available, by far the best choice is to visit an independent broker.

He or she will be able to talk through your options, as well as make suggestions you may not have considered. They will also be able to make recommendations on good companies to work with and will be able to guide you through the whole process.

As children are staying at home longer than ever, parents are increasingly having to decide on what the best financial options are for their children long into their adulthood. With 33 percent of 25-29-year-olds now living at home (and the trend looking set to continue for the foreseeable future), children are delaying the point of their financial independence

.

There are many pros and cons of a child staying on their parents’ car insurance. For example, while it’s cheaper for the child to stay on a parents’ policy, it does increase the parents’ rates.

After graduation is a great time to re-evaluate if your child should get their own auto insurance. That gives the child time to become independent, which will give you more options.

When it comes to having children on parents’ insurance, the options are far greater than they may initially seem. The absence of an upper age limit gives greater flexibility to parents, meaning that it is much more a financial decision than a logistical one.

Until what age can you stay on your parents’ car insurance? Now that you know, get auto insurance quotes easily by using our free tool below. Enter your ZIP code now to get affordable auto insurance.

Do you have more questions about staying on your parents’ auto insurance?

We hope we’ve covered everything and answered the question, “How long can a child stay on their parents’ auto insurance?” But just in case, feel free to take a look at some frequently asked questions below.

#1 – Can I be on my parents’ auto insurance if the car is in my name?

You might be wondering, can I be on my parents’ car insurance if the car is in my name? In most cases, if the car is in your name as sole owner, then you won’t be able to stay on your parents’ auto insurance policy.

#2 – How long can your child stay on your auto insurance?

How long can children stay on parents’ insurance? The answer to this question differs in almost every case. There are a number of factors to consider as we’ve gone over in our article.

#3 – Can I be on my parents’ auto insurance if I live in a different state?

Usually, you can only stay on your parents’ insurance for a different state if you are a student going to an out-of-state school.

#4 – Can I get insured on my parents’ car?

In most cases, children can get added to their parents’ auto insurance plan.

#5 – Do all drivers in a household have to be insured?

It is a good idea to have everyone in your household listed on your auto insurance policy, even if they drive only minimally.

#6 – Can I add someone to my auto insurance that doesn’t live with me?

This can depend on your specific auto insurance company, but for the most part, companies won’t allow you to add someone who doesn’t live with you to your policy.

Reviewed by:

Licensed Insurance Agent Cynthia Lanctot