Car Insurance for women

why is it cheaper

compared to men?

Introduction

It’s a widely known fact that women pay less in annual premiums on their car insurance compared to men. In fact, across all ages and other demographic slices, women pay annual premiums of $1,427 per annum, where the average cost for men is $1,434.

This represents a percentage difference of just 0.5%, although it can be larger for some age groups. Conversely, for some age groups, men actually pay less for car insurance.

Understanding how and why women pay less for car insurance may help you discover how insurance works and how you can save money on insurance, regardless of your gender.

The pricing gap

The gap between men and women’s insurance premiums varies by age. Before the age of 25, the average gap between men and women’s premiums (all other things being equal) is up to 13%. After the age of 25, the average difference is approximately 0.5%.

This equals a $7 difference on a premium of around $1,500. In fact, between the ages of 30-35, men’s premiums are actually cheaper than those of women. However, this value is marginal and reverses past the age of 35.

The gender discrepancy across all ages is, in reality, caused by the sizeable gap between men and women drivers in their teenage years. The huge gaps here effectively shapes the averages across the board. Even though rates are high for this age group, there are a handful of companies that offer the best auto insurance for young adults, which can offset some of that expense. For more information, see buy cheap auto insurance for young adults.

Compared to other factors, gender plays a minuscule role when it comes to shaping the cost of insurance premiums. The role gender plays in insurance premium is rooted in a variety of statistical factors.

Statistical background

Insurance companies base premiums on a wide range of data. The gap between male and female insurance rates is fundamentally a product of statistics, and across the board, the statistics show discrepancies between male and female drivers.

Frequency of accidents

The most obvious discrepancy is simply the frequency of accidents. To a certain extent, men are more likely to crash because they drive more. On average, 60% of miles driven in the United States each year are driven by men.

However, even adjusting for this, men are more likely to crash. The Insurance Institute for Highway Safety (IIHS) reported the following statistics (all true as of 2013):

-

71% of all deaths stemming from car accidents were men.

-

Men are 50% more likely

to be involved in a crash. -

Men are more likely to be under the influence in fatal crashes.

Given these key metrics, it is perhaps unsurprising that there is a gap in insurance costs between men and women. For more information on insurance rates and accidents, see cheap auto insurance companies that accept drivers with multiple accidents.

Type of accidents

A study by the Journal of Safety research found that there was a great deal of discrepancy not just in the frequency of accidents by gender, but also by the type of accidents that each gender has. The results showed a variety of interesting conclusions when it comes to gender differences with regards to insurance claims:

Women aged less than 30 are more likely than men to be involved in car accidents that involved pedestrians and intersections; men aged less than 30 are more likely to crash in rural areas.

Women are more likely to crash between 9am and 5pm Monday to Friday (i.e. during work hours) whereas men are likely to crash after sunset on weekends.

-

Women are 28% more

likely to drive on a

restricted license. -

Women are 66% more likely

to wear a seatbelt. -

Teenage men are twice as

likely to be in a fatal accident

than teenage women.

Men are more likely to commit a hit-and-run.

In crashes of equal severity, women are more likely to be injured and have more extensive injuries than are men (due mostly to differences in body size and strength).

The most common crashes involving men are rear-end crashes, whereas the most common crashes involving women are right-angle crashes (T-boning).

These dramatic differences have major ramifications when it comes to the cost of an accident. For example, the fact that a woman is more likely to experience physical harm from a crash has a knock-on effect when it comes to the potential medical costs of rehabilitation. Men are more likely to get a DUI or to get a ticket for speeding.

How car insurance rates change after an accident depends on a number of different factors. One of those factors is the cost. Because of the different costs of these infractions, insurance companies weigh the cost of premiums differently.

Moving violations

Men are more likely to speed than women. According to the National Highway Traffic Safety Administration (NHTSA), in fatal accidents involving men, speeding was a factor in 24% of cases.

By contrast, for fatal crashes involving women, speeding was a factor in 15% of cases. This shows that, men are more likely to speed than are women, making them a riskier prospect to insure.

For more details on moving violations, see insurance points.

DUIs

According to research from the FBI, 536,202 men were arrested for DUIs in 2013. By contrast, 174,149 women were arrested on the same charge.

That means that men are more than three times as likely to be arrested for a DUI. Since a DUI has a major impact on car insurance premiums, the gender discrepancy will have a major impact on the average cost of premiums across the genders.

A DUI conviction can double the cost of an insurance premium and is likely to influence the cost of a premium for 5-10 years (and for life in the instance of multiple DUI convictions). Being convicted of a DUI can affect who will cover you as well, but there are cheap auto insurance companies that accept DUIs (2022).

Age as a factor

According to the Center for Disease Control (CDC), a driver aged 16-20 is four times more likely to crash than a driver aged 21+. As a result, the insurance premiums are far higher; teen drivers pay by far the highest premiums of any demographic, regardless of gender. However, even within these high premiums, there is a gender insurance gap. In fact, gender differences are highest for young drivers.

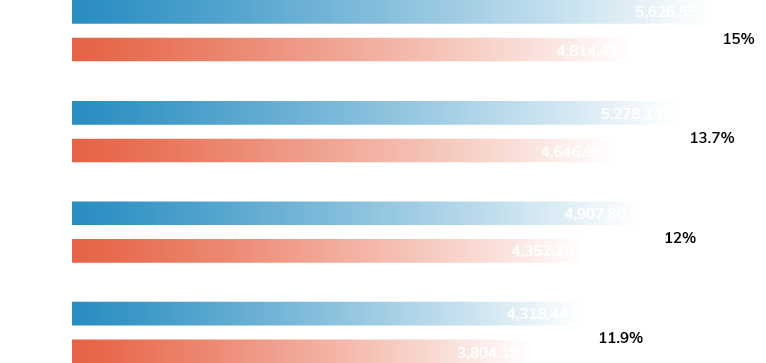

As the table below shows, the gender pay gap for young drivers is dramatic, although it does diminish as a driver gets older.

-

Average male Premium

per annum ($) -

Average female Premium

per annum ($) -

Difference in

Premiums

The average female teen driver pays 13% less for car insurance than her male counterpart. This is supported by data that shows that a female teen driver is less likely to get a ticket or crash than a male teen driver. For more information, see average auto insurance rates by age.

Other factors

Gender does, therefore, play a role when it comes to shaping insurance premium prices. However, it is not the only factor. In fact, as you get older, it diminishes as a factor in determining insurance premium prices. Past the age of about 25, car insurance is shaped by factors far greater than gender. The biggest four factors in influencing car insurance premiums are:

- Marriage

- Cost of Car

- Location

- Driving History

Car insurance is a measure of risk, or how likely car insurance companies think it is that you will have a claim filed against your policy. After the age of 25, the statistics show little gender discrepancy between men and women when it comes to accidents and moving violations. As a result, insurance companies accord it little value when it comes to shaping insurance premiums.

You can also see how to lower your auto insurance rates and make your coverage more affordable.

Marriage

Marriage may seem like a tangential factor when it comes to driving, but studies have shown that it correlates with a reduced risk of crashing. Secondary factors such as health also improves when you get married.

As a result, car insurance companies have lower premiums for those who are married, because they are less likely to crash. This diminishes with age, although at a younger age, the differences in premium price between married and unmarried drivers is significant. For more information, see buy cheapest auto insurance for married couples.

An unmarried 20-year-old man pays 25% more for his premium than if he were married. An unmarried 20-year-old woman pays 28% more than her married counterpart. This diminishes with age, so an unmarried 25-year-old (of both genders) will pay 7% more than a married person. By the age of 30, the difference between married and unmarried prices is reduced to 0%.

Location

Where you live has a major bearing on the cost of your insurance premiums. Your insurance company calculates your premium based on the frequency of accidents and crime levels in your zip code. See how crime affects rates by checking out the 15 cities with the most car theft.

Moreover, the specific location of your home is a factor, in terms of whether your car is parked on-street, off-street, or in a garage. You can find cheap auto insurance companies that don’t ask for proof of garaging.

Cost of Car

The cost of your car is also a crucial detail. Expensive cars are more expensive to fix, whereas a cheap car, combined with a high deductible, is a cheap way for you to save money on your premium.

Driving History

Probably the biggest influence on the overall cost of your premium is your driving history. Insurance companies take your likelihood of a crash as a function of your previous instances without a crash.

If you haven’t required a claim payment within the previous 10 years, your insurance company will regard you as being less likely to require a payout in the future. This is far more important to an insurance company than your gender.

For more details, see how far back do auto insurance companies look?

Legality

A crucial question that many drivers have is how and why it is legal for insurers to have gender insurance gap differences, particularly at a time when gender equality seems to be progressing in other forms of life. In 2012, the European Union rules that car insurance companies were not allowed to discriminate on the basis of gender.

The European Court of Justice ruled that different premiums for men and women, ‘were incompatible with the principle of unisex pricing included in EU gender equality legislation.’ Car insurance companies across the European Union are, therefore, now prohibited from using gender as a factor in costing a car insurance premium, as they would be from taking into account racial, ethnic, or sexuality.

In the United States, there has been some similar legislation, although nothing as far-reaching as the European Union. Some states don’t use gender as a factor when it comes to car insurance. In Hawaii, Massachusetts, and Montana, it is not permitted for insurance companies to discriminate based on gender. In the vast majority of states, however, it can still be used as a metric when costing a car insurance premium.

Read more:

In reality, comparing between genders is not a helpful way of considering car insurance, since each driver is priced on an individual basis. Factors such as driving history, your age, the car you drive, your location, and your credit history are all much more important factors in shaping your insurance.

Conclusion

There’s not much you can do about changing your demographic slice when it comes to car insurance. Instead, you should focus on the things you can change. Improving your driving record, taking an advanced driving course, buying a cheaper car, and adjusting your deductibles are all far more tangible ways to reduce your car insurance premiums than focusing on gender differences.

Ultimately, as you get older, the gap between male and female insurance premiums diminishes to a near negligible amount, meaning that you will not be missing out on significant savings by the time you get past your 20s.

Indeed, in so far as there is a gap between male and female insurance premiums, it really only manifests for teens and drivers in the early 20s. The gap in premium prices is, at this age, so large, it affects the averages for all ages. At any other age, gender is an extremely marginal factor.