How

texting and driving

affects you, your community, and your insurance policy

-

Texting and driving statistics continue to show a dire impact on communities around the nation. How does this affect the typical cost of insurance premiums? And, are their ways for you to protect yourself from undue spikes?

-

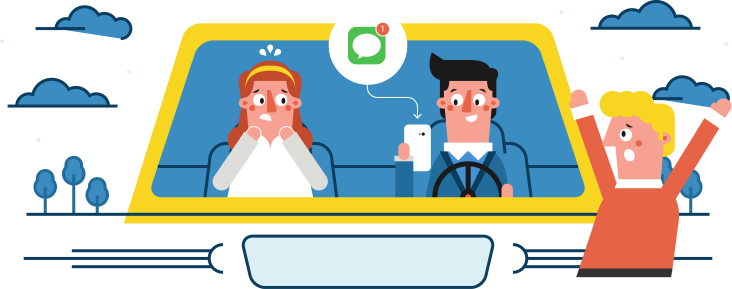

Texting and driving is harmful to everyone.

-

It’s common for drivers to completely abandon control of a vehicle while texting. This means drivers can be oblivious to critical events, objects, and cues. Recklessness of this type inevitably leads to car accidents. In fact, the National Safety Council reports that

cell phone use, while driving, leads to

1.6 million crashes each year. -

The idea of distracted driving isn’t a new one. Still, as technology becomes more ingrained in our culture, the issue continues to amplify.

-

Individual states and insurance companies continue to introduce legislation and policy increases to ward off this dangerous practice.

But, texting and driving still remains common practice for many drivers. As a result, more drastic measures are starting to take place.

-

How do texting and driving statistics relate to your insurance premium? As it turns out, they can go hand-in-hand with each other, no matter if you have full coverage car insurance or simply temporary insurance coverage.

How much danger does texting while driving pose?

We send texts all the time. This seemingly mundane task has become commonplace, making it easy to forget it’s actually a distraction. The moment we hear the “ding” of our phones, we’re conditioned to look and maybe even respond—regardless of if we are behind the wheel or not.

-

98%49%

According to a 2013 survey sanctioned by AT&T, 98%

of adult drivers surveyed, acknowledged that distracted driving isn’t safe. Yet, 49% also said that they are guilty of the practice. -

As the evolution of technology increases, so do our options for being distracted.

From cell phones to smartwatches we are more connected than ever. In 2010, 6 out of 10 drivers said they never texted behind the wheel just three years earlier. And as the years press forward, the statistics aren’t getting better.

-

What is the current landscape of texting and driving?

By the numbers: The most shocking texting and driving statistics

After analyzing the National Highways Traffic Safety Administration’s (NHTSA) aggregation of distracted driving reports and crash statistics, we found the following the most striking.

-

Texting and driving causes 1

out of every 4 car accidents in the United States. -

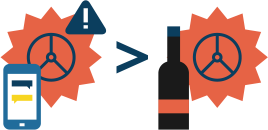

Texting while driving is

6 times more likely to cause an accident than driving drunk. -

Texting while driving causes a 400% increase in time spent with eyes off the road.

-

94% of drivers support a ban on texting while driving.

-

74% of drivers support a ban on hand-held cell phone use.

-

According to the NHTSA, at any given moment during the daylight hours, over 800,000 vehicles are being driven by someone using a hand-held cell phone.

-

The NHTSA also says that taking your eyes off the road for more than 2 seconds doubles your risk of a crash. If you are driving at 55 mph, and take your eyes off the road for five seconds, you will have driven the length of a football field without looking at the road.

-

Perhaps the scariest fact is that many of these figures are low-ball estimates. The precise figures are unknown because it can be difficult to measure the extent to which driver distraction is a contributing factor in a crash.

-

Regardless, we know we need to rectify the problem. In order to do so, we must first understand who is most likely to offend.

Who is the most likely to text and drive?

-

A study by AT&T in 2015 showed that 62% of drivers keep their smartphones within easy reach while driving. It is difficult for some drivers to ignore this temptation. Who is most likely to fall victim to the distraction?

Data shows frequent offenders tend to fall within one of two categories:

-

Category one

The younger more inexperienced drivers, or those under 20 years old, are the most likely to have distraction-related fatal crashes.

According to the CDC’s national Youth Risk Behavior Surveillance System (YRBSS), a program that monitors health-risk behaviors among high school students, in 2015, 42% of high school students who drove in the past 30 days reported sending a text or email while driving. That’s why it costs more to insure 18 year old drivers.

-

Category two

Additionally, commercial drivers are a demographic to watch. Not only because of the frequency of texting, but due to the damage commercial drivers can cause if they get into an accident.

A Virginia Tech Transportation Institute study of commercial drivers revealed that texting while driving was the riskiest type of driver distraction, making drivers 23 times more likely of getting into a “safety-critical event.”

The problem of texting and driving is more than meets the eye. Studies show that those who admit to texting while driving were also:

-

Less likely to

wear a seat belt. -

More likely to

ride with a driverwho had

been drinking. -

More likely

to drink and drive. -

Manipulate hands-free

devices (hands-free

isn’t risk-free).

AT&T also revealed that nearly 4 in 10 drivers with smartphones use social media while driving. Facebook is the most common application used while driving, and one in seven smartphone users admit to using Twitter while behind the wheel.

Here is a breakdown of smartphone activities people say they do while driving, as according to AT&T’s study:

-

Text

61% -

Email

33% -

Surf the net

28% -

Facebook

27% -

Snap a selfie or photo

17% -

Twitter

14% -

Instagram

14% -

Shoot a video

12% -

Snapchat

11% -

Video chat

10%

While texting is still the largest problem, it seems the true problem of distracted driving relates to anything related to a smartphone.

As the rise of distracted driving accidents and fatalities continues to climb, both insurance companies and government are stepping in. As a result, car insurance prices for teens are higher and more restrictions are being placed on them.

What is your state doing to prevent driving and texting?

In an effort to discourage this deadly behavior, many states aim to punish distracted drivers. As of 2018, 46 states (and the District of Columbia) have made it totally illegal to text and drive.

The four states that don’t ban text messaging, entirely, are:

-

Arizona

-

Montana

-

Missouri

-

Texas

While it’s not entirely illegal in these states, there still is some legislature to limit texting and driving.

For instance, in Montana and Arizona, everyone except for school bus drivers is permitted to use cell phones. In Missouri, texting and driving is only banned for drivers under the age of 21.

And Texas limits texting and driving based on age and location (for instance, you can’t text in a school zone).

For a full look at the laws in your state, refer to the Governor’s Highway Safety Association datasheet.

Public and private foundations are also taking a stand to prevent distracted driving.

Apart from the well-known AdCouncil campaigns against distracted driving, non-profits like Impact Teen Drivers and EndDD share missions to save lives from distracted driving through advocacy, education and action.

Many people won’t change their habits until it directly impacts them.

Can insurance companies react to texting and driving?

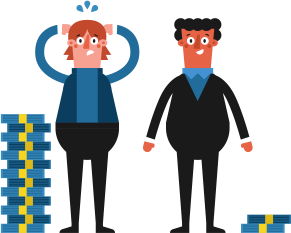

As driving becomes riskier, the utilization of insurance plans is likely to rise. This means more money out of insurer’s pockets, which isn’t boding well for these companies. As a result, insurers are passing the costs along to their customers.

Bill Caldwell, executive vice president of property and casualty at Horace Mann Insurance recently told the Wall Street Times that his company plans to hike auto insurance premiums an average of 8% this year to make up for the costs associated to accidents caused by distracted driving.

The only states that don’t allow insurance companies to consider texting tickets when setting premiums are:

- Washington

- Massachusetts

- Idaho

- North Carolina

Some states use a point system for insurance increases. The more serious the violation, the more points are assigned to a driver’s record. So for instance, when you are convicted of a traffic offense in Texas, you will be given:

2 points for any moving violation.

3 points for violations resulting in a collision.

These violations affect how much you pay for car insurance. The more points, the higher your premium will be. And, if you accumulate too many points, your license may be suspended and you’ll be left with car insurance without a license. In many states, tickets for texting-and-driving will add points to a driver’s record.

Currently, the only states that don’t assign points for texting-while-driving tickets are:

-

California

-

Louisiana

-

Delaware

-

Pennsylvania

-

Iowa

-

Tennessee

If you’ve been given a ticket for texting-and-driving in any of the states outside of those six, it’s likely you saw—or will see— an increase in your premium the next time you renewed your insurance. You might need to get insurance for high risk drivers.

It’s also important to remember that there are a number of variables working together to create your premium. It’s always important, regardless of your driving record, to compare insurance rates before renewing insurance.

If you fall on the positive side of this problem, and you don’t drive distracted, it might be even more important to compare insurance rates in the near future.

Insurers are working hard to better understand their customers, and reward for their responsible customers more consistently, as well as offer some cheap car insurance options with no deposit.

Data is helping inform insurance companies, and policy costs

While states are trying to punish texting and driving violators before an accident occurs, the statistics aren’t getting any better.

For this reason, insurers are beginning to collect more informed data. Depending on what type of insurance you have, using your phone while driving— even if you’re using hands-free technology— could result in higher insurance premiums.

Arity, a unit of insurance giant Allstate, analyzed data from 160 million trips by hundreds of thousands of Allstate drivers. The study confirmed that drivers on their phones, in any capacity are more dangerous. This includes texting, social media use, photo ops, and even hands-free technology.

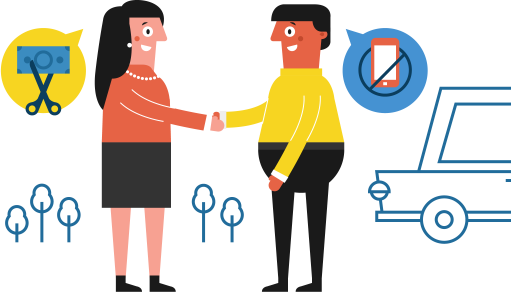

To deter drivers from using their cell phones while driving, Allstate is tracking in-car smartphone use and increasing or decreasing premiums depending on how often their customers use their phone while driving.

Safe drivers have the advantage now. Insurance companies will be vying for them because they cost less as customers.

Compare costs when making decisions about insurance

Insurers are making adjustments to their pricing structure based on informed data, which opens the door for promotions and campaigns to attract the safest drivers. That makes right now a great time to compare car insurance quotes.

When you compare different car insurance companies, you might be surprised to see your current insurer calculates premiums differently than a competitor, especially if you haven’t compared in a while.

You could find that you’re currently

paying too much for insurance.

Look at our car insurance comparison tool to understand your situation more clearly. Are you eligible for any discounts or price breaks for your responsible driving practices?

Conclusion

Put the phone down and save

We know it’s a bad habit to be on the phone while operating a vehicle.

Apart from the dangers it poses, we also know now that texting and driving is costing us money.

Most of us are hopelessly tied to our electronic devices. We are conditioned to receive and provide fast responses regardless of the time of the day, or what we are doing at the time.

-

Unfortunately, this is a dangerous and expensive trap we’ve built for ourselves. One we need to escape.

-

Reflect on this information and please put the phone down while driving.

- https://www.att.com/Common/about_us/pdf/twd_commutor_survey.pdf

- https://crashstats.nhtsa.dot.gov/

- http://www.nhtsa.gov.edgesuite-staging.net/Driving+Safety/Distracted+Driving/Policy+Statement+and+Co

- https://about.att.com/story/smartphone_use_while_driving_grows_beyond_texting.html

- https://www.nhtsa.gov/crash-avoidance/office-crash-avoidance-research-technical-publications

- https://www.ghsa.org/state-laws/issues/distracted%20driving

- https://www.ghsa.org/sites/default/files/2017-07/DistractedDrivingLawChart_July17.pdf

- https://www.adcouncil.org/campaign/distracted-driving-prevention

- https://www.impactteendrivers.org/

- https://www.enddd.org/about-enddd/

- https://www.dmv.org/tx-texas/point-system.php

- https://money.cnn.com/2018/01/24/technology/texting-and-driving-distracted/index.html